Summary

With the recent rise of Machine Learning as a candidate to partially replace classic Financial Mathematics methodologies, we investigate the performances of both in solving the problem of dynamic portfolio optimization in continuous-time, finite-horizon setting for a portfolio of two assets that are intertwined. In Financial Mathematics approach we model the asset prices not via the common approaches used in pairs trading such as a high correlation or cointegration, but with the cointelation model that aims to reconcile both short-term risk and long-term equilibrium. We maximize the overall P&L with Financial Mathematics approach that dynamically switches between a mean-variance optimal strategy and a power utility maximizing strategy. We use a stochastic control formulation of the problem of power utility maximization and solve numerically the resulting HJB equation with the Deep Galerkin method. We turn to Machine Learning for the same P&L maximization problem and use clustering analysis to devise bands, combined with in-band optimization. Although this approach is model agnostic, results obtained with data simulated from the same cointelation model as FM give an edge to ML.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

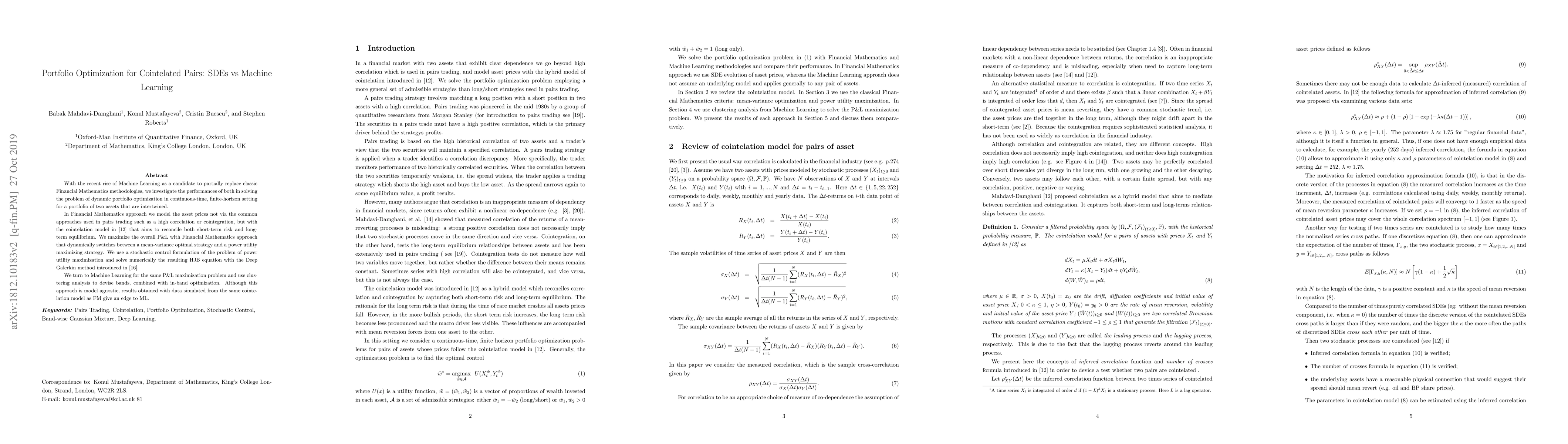

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTransfer Learning for Portfolio Optimization

Xin Guo, Mathieu Rosenbaum, Haoyang Cao et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)