Summary

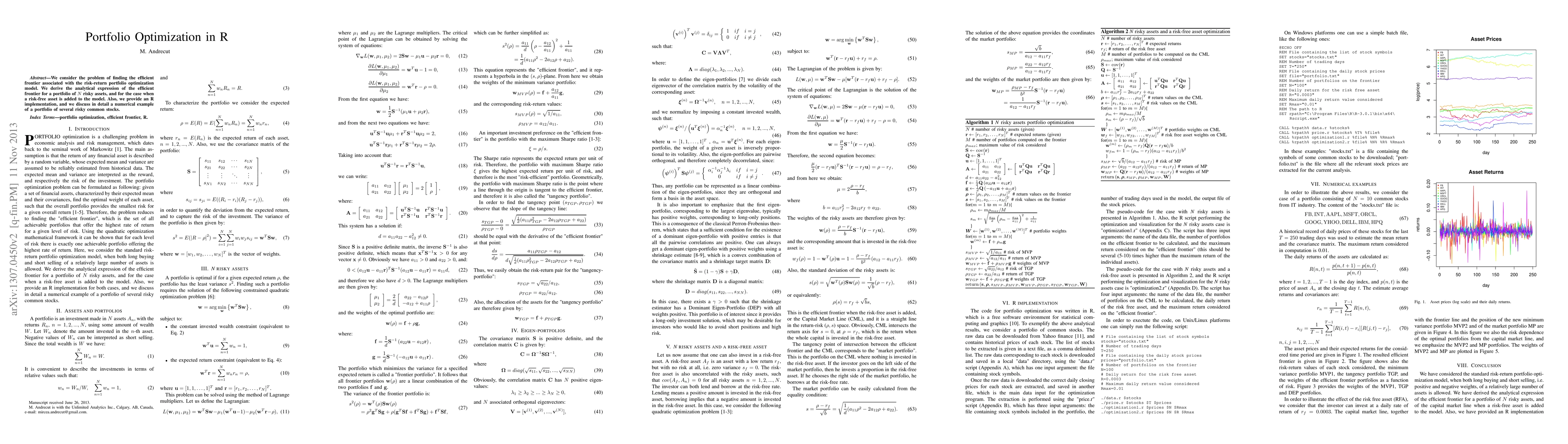

We consider the problem of finding the efficient frontier associated with the risk-return portfolio optimization model. We derive the analytical expression of the efficient frontier for a portfolio of N risky assets, and for the case when a risk-free asset is added to the model. Also, we provide an R implementation, and we discuss in detail a numerical example of a portfolio of several risky common stocks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersskfolio: Portfolio Optimization in Python

Carlo Nicolini, Matteo Manzi, Hugo Delatte

CV@R penalized portfolio optimization with biased stochastic mirror descent

Manon Costa, Sébastien Gadat, Lorick Huang

| Title | Authors | Year | Actions |

|---|

Comments (0)