Summary

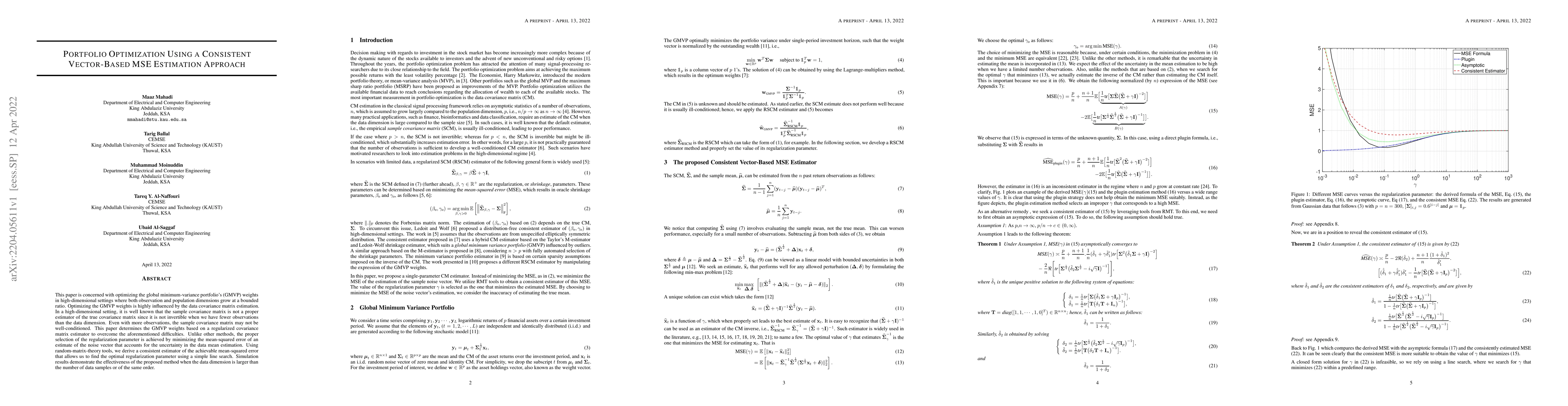

This paper is concerned with optimizing the global minimum-variance portfolio's (GMVP) weights in high-dimensional settings where both observation and population dimensions grow at a bounded ratio. Optimizing the GMVP weights is highly influenced by the data covariance matrix estimation. In a high-dimensional setting, it is well known that the sample covariance matrix is not a proper estimator of the true covariance matrix since it is not invertible when we have fewer observations than the data dimension. Even with more observations, the sample covariance matrix may not be well-conditioned. This paper determines the GMVP weights based on a regularized covariance matrix estimator to overcome the aforementioned difficulties. Unlike other methods, the proper selection of the regularization parameter is achieved by minimizing the mean-squared error of an estimate of the noise vector that accounts for the uncertainty in the data mean estimation. Using random-matrix-theory tools, we derive a consistent estimator of the achievable mean-squared error that allows us to find the optimal regularization parameter using a simple line search. Simulation results demonstrate the effectiveness of the proposed method when the data dimension is larger than the number of data samples or of the same order.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPortfolio optimization with mixture vector autoregressive models

Georgi N. Boshnakov, Davide Ravagli

| Title | Authors | Year | Actions |

|---|

Comments (0)