Summary

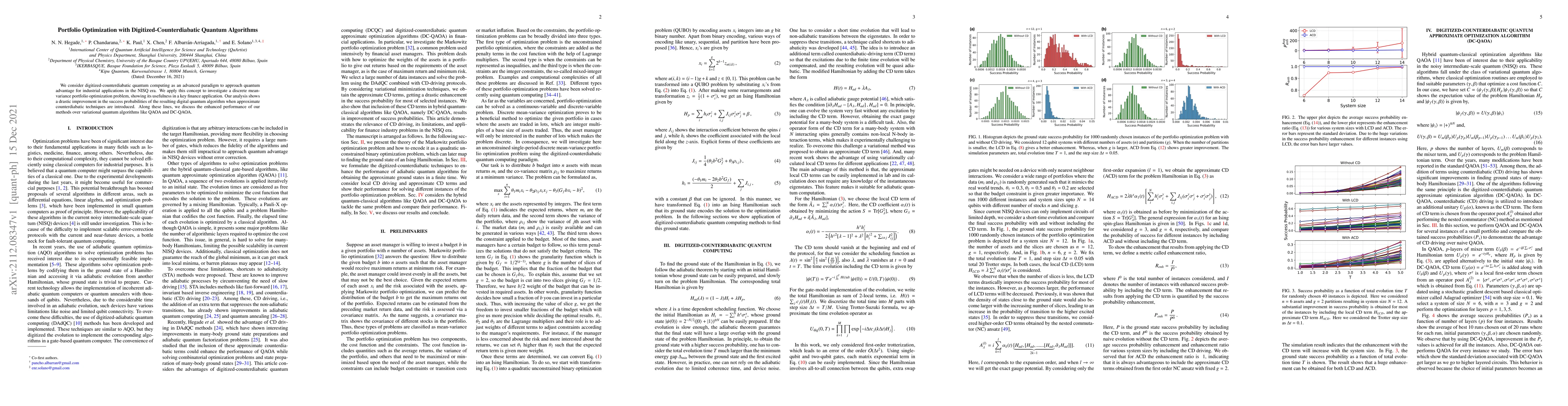

We consider digitized-counterdiabatic quantum computing as an advanced paradigm to approach quantum advantage for industrial applications in the NISQ era. We apply this concept to investigate a discrete mean-variance portfolio optimization problem, showing its usefulness in a key finance application. Our analysis shows a drastic improvement in the success probabilities of the resulting digital quantum algorithm when approximate counterdiabatic techniques are introduced. Along these lines, we discuss the enhanced performance of our methods over variational quantum algorithms like QAOA and DC-QAOA.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDigitized-Counterdiabatic Quantum Optimization

Xi Chen, Enrique Solano, Narendra N. Hegade

Digitized Counterdiabatic Quantum Algorithms for Logistics Scheduling

Enrique Solano, Archismita Dalal, Iraitz Montalban et al.

Bias-field digitized counterdiabatic quantum optimization

Enrique Solano, Archismita Dalal, Narendra N. Hegade et al.

Digitized-counterdiabatic quantum approximate optimization algorithm

Xi Chen, E. Solano, F. Albarrán-Arriagada et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)