Summary

We provide analytical results for a static portfolio optimization problem with two coherent risk measures. The use of two risk measures is motivated by joint decision-making for portfolio selection where the risk perception of the portfolio manager is of primary concern, hence, it appears in the objective function, and the risk perception of an external authority needs to be taken into account as well, which appears in the form of a risk constraint. The problem covers the risk minimization problem with an expected return constraint and the expected return maximization problem with a risk constraint, as special cases. For the general case of an arbitrary joint distribution for the asset returns, under certain conditions, we characterize the optimal portfolio as the optimal Lagrange multiplier associated to an equality-constrained dual problem. Then, we consider the special case of Gaussian returns for which it is possible to identify all cases where an optimal solution exists and to give an explicit formula for the optimal portfolio whenever it exists.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

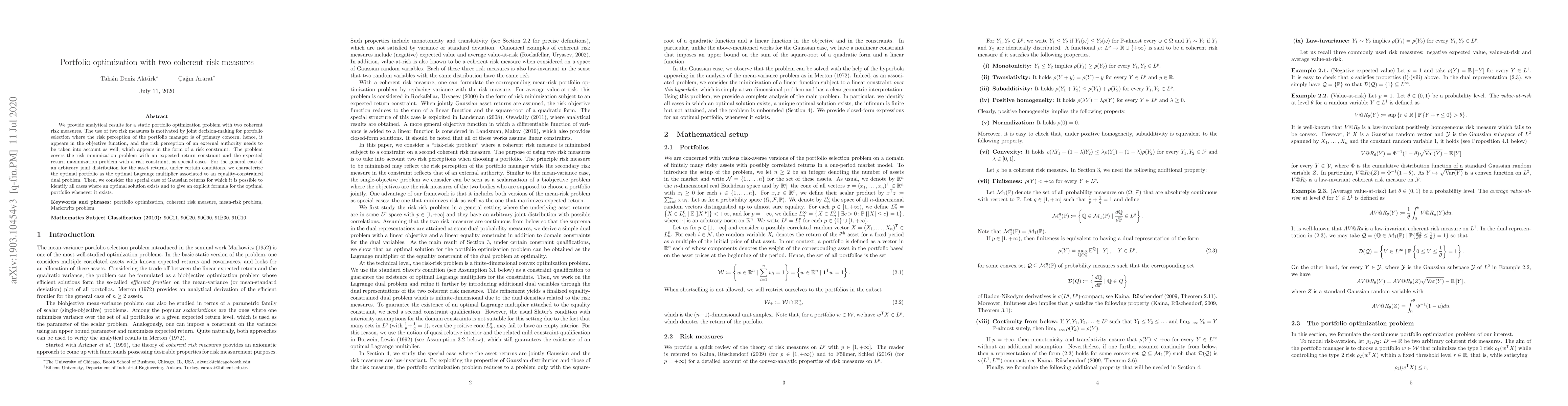

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)