Summary

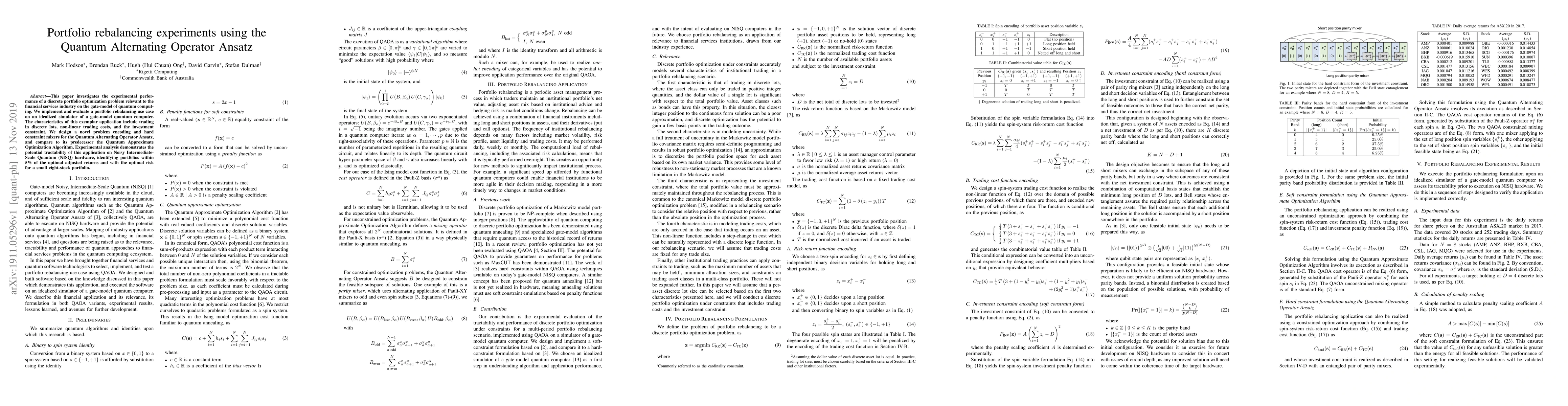

This paper investigates the experimental performance of a discrete portfolio optimization problem relevant to the financial services industry on the gate-model of quantum computing. We implement and evaluate a portfolio rebalancing use case on an idealized simulator of a gate-model quantum computer. The characteristics of this exemplar application include trading in discrete lots, non-linear trading costs, and the investment constraint. We design a novel problem encoding and hard constraint mixers for the Quantum Alternating Operator Ansatz, and compare to its predecessor the Quantum Approximate Optimization Algorithm. Experimental analysis demonstrates the potential tractability of this application on Noisy Intermediate-Scale Quantum (NISQ) hardware, identifying portfolios within 5% of the optimal adjusted returns and with the optimal risk for a small eight-stock portfolio.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCounting with the quantum alternating operator ansatz

Stefanos Kourtis, Shreya Banerjee, Julien Drapeau

Performance Upper Bound of Grover-Mixer Quantum Alternating Operator Ansatz

Jiahua Xu, Tiejin Chen, Ningyi Xie et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)