Summary

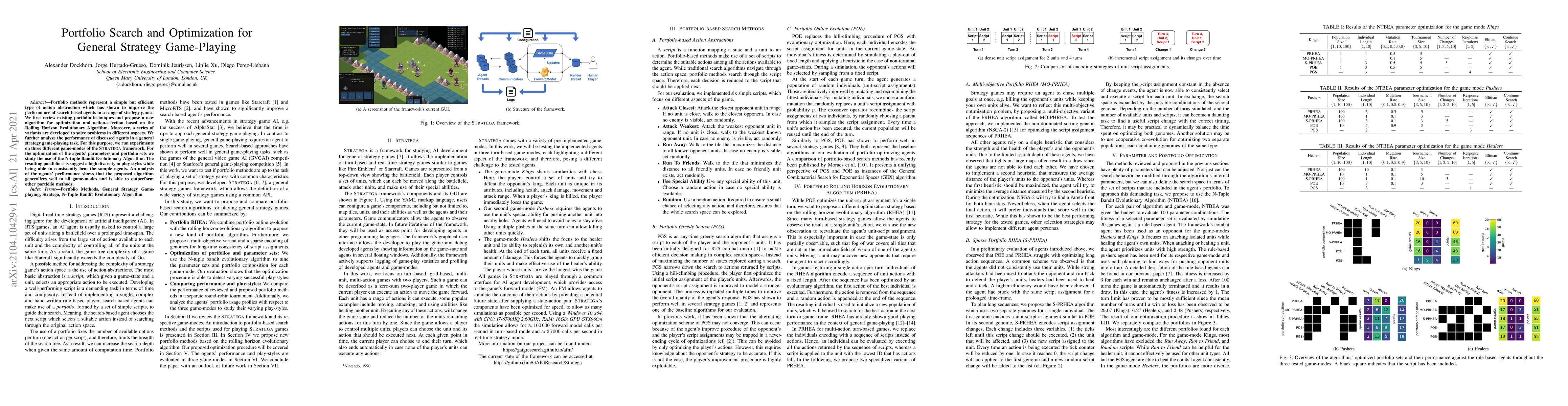

Portfolio methods represent a simple but efficient type of action abstraction which has shown to improve the performance of search-based agents in a range of strategy games. We first review existing portfolio techniques and propose a new algorithm for optimization and action-selection based on the Rolling Horizon Evolutionary Algorithm. Moreover, a series of variants are developed to solve problems in different aspects. We further analyze the performance of discussed agents in a general strategy game-playing task. For this purpose, we run experiments on three different game-modes of the Stratega framework. For the optimization of the agents' parameters and portfolio sets we study the use of the N-tuple Bandit Evolutionary Algorithm. The resulting portfolio sets suggest a high diversity in play-styles while being able to consistently beat the sample agents. An analysis of the agents' performance shows that the proposed algorithm generalizes well to all game-modes and is able to outperform other portfolio methods.

AI Key Findings

Generated Sep 07, 2025

Methodology

The paper proposes three new portfolio methods (PRHEA, MO-PRHEA, S-PRHEA) based on the Rolling Horizon Evolutionary Algorithm (RHEA) for strategy game-playing. It uses the N-Tuple Bandit Evolutionary Algorithm (NTBEA) to optimize parameters and portfolio sets.

Key Results

- PRHEA outperformed other methods in all tested game modes (Kings, Healers, Pushers) against rule-based agents and baseline methods.

- The optimized portfolio sets showed high diversity in play-styles, consistently beating sample agents.

- PRHEA generalized well across different game-modes, outperforming other portfolio methods.

- NTBEA uncovered a variety of play-styles in the STRATEGA framework's three tested game modes.

- Agents favored different play-styles when provided with the whole set of scripts, highlighting optimization opportunities for methods like NTBEA.

Significance

This research contributes to the development of more efficient search-based agents in strategy games by proposing new portfolio methods and demonstrating the potential of optimization techniques like NTBEA for uncovering novel play-styles.

Technical Contribution

The paper introduces PRHEA, MO-PRHEA, and S-PRHEA, new portfolio methods based on RHEA, and NTBEA for optimizing parameters and portfolio sets in strategy game-playing.

Novelty

The work is novel in its application of RHEA-based methods and NTBEA for portfolio optimization in strategy games, demonstrating improved performance and uncovering diverse play-styles.

Limitations

- The study was limited to the STRATEGA framework, which may not fully represent the complexity of all strategy games.

- The performance of the proposed methods was evaluated against rule-based agents, and real-world applicability against human or advanced AI opponents remains to be seen.

Future Work

- Extend the analysis on portfolio optimization to enhance the variability of search-based agents.

- Analyze methods for script generation to explore the strategy space and complement an agent's portfolio.

- Investigate game-state abstractions to improve search efficiency in large state spaces common in strategy games.

- Incorporate more complex games into the STRATEGA framework for a broader evaluation.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnhancements for Real-Time Monte-Carlo Tree Search in General Video Game Playing

Dennis J. N. J. Soemers, Chiara F. Sironi, Torsten Schuster et al.

Elastic Monte Carlo Tree Search with State Abstraction for Strategy Game Playing

Linjie Xu, Alexander Dockhorn, Jorge Hurtado-Grueso et al.

Strategy Game-Playing with Size-Constrained State Abstraction

Linjie Xu, Diego Perez-Liebana, Alexander Dockhorn

| Title | Authors | Year | Actions |

|---|

Comments (0)