Summary

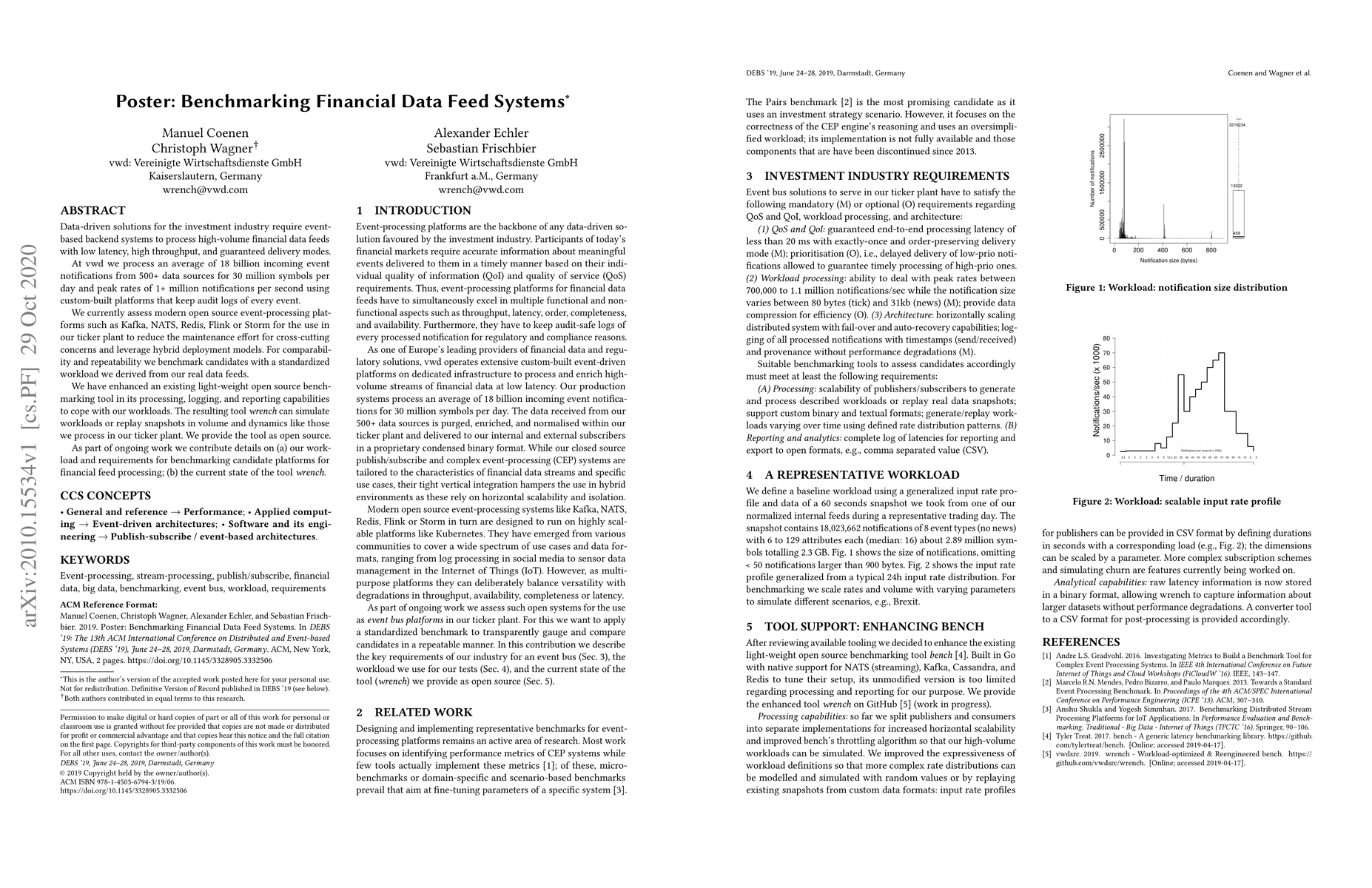

Data-driven solutions for the investment industry require event-based backend systems to process high-volume financial data feeds with low latency, high throughput, and guaranteed delivery modes. At vwd we process an average of 18 billion incoming event notifications from 500+ data sources for 30 million symbols per day and peak rates of 1+ million notifications per second using custom-built platforms that keep audit logs of every event. We currently assess modern open source event-processing platforms such as Kafka, NATS, Redis, Flink or Storm for the use in our ticker plant to reduce the maintenance effort for cross-cutting concerns and leverage hybrid deployment models. For comparability and repeatability we benchmark candidates with a standardized workload we derived from our real data feeds. We have enhanced an existing light-weight open source benchmarking tool in its processing, logging, and reporting capabilities to cope with our workloads. The resulting tool wrench can simulate workloads or replay snapshots in volume and dynamics like those we process in our ticker plant. We provide the tool as open source. As part of ongoing work we contribute details on (a) our workload and requirements for benchmarking candidate platforms for financial feed processing; (b) the current state of the tool wrench.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)