Authors

Summary

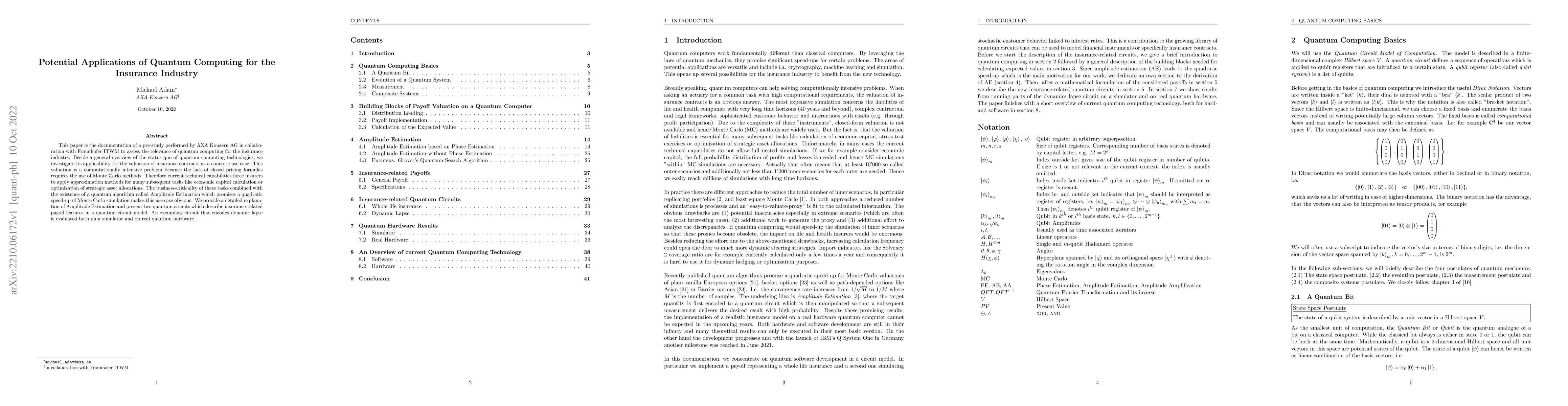

This paper is the documentation of a pre-study performed by AXA Konzern AG in collaboration with Fraunhofer ITWM to assess the relevance of quantum computing for the insurance industry. Beside a general overview of the status quo of quantum computing technologies, we investigate its applicability for the valuation of insurance contracts as a concrete use case. This valuation is a computationally intensive problem because the lack of closed pricing formulas requires the use of Monte Carlo methods. Therefore current technical capabilities force insurers to apply approximation methods for many subsequent tasks like economic capital calculation or optimization of strategic asset allocations. The business-criticality of these tasks combined with the existence of a quantum algorithm called Amplitude Estimation which promises a quadratic speed-up of Monte Carlo simulation makes this use case obvious. We provide a detailed explanation of Amplitude Estimation and present two quantum circuits which describe insurance-related payoff features in a quantum circuit model. An exemplary circuit that encodes dynamic lapse is evaluated both on a simulator and on real quantum hardware.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Structured Survey of Quantum Computing for the Financial Industry

Esther Hänggi, Thomas Ankenbrand, Stefan Stettler et al.

Federated Fog Computing for Remote Industry 4.0 Applications

Mohsen Amini Salehi, Razin Farhan Hussain

Industry applications of neutral-atom quantum computing solving independent set problems

Jonathan Wurtz, Pedro L. S. Lopes, Nathan Gemelke et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)