Authors

Summary

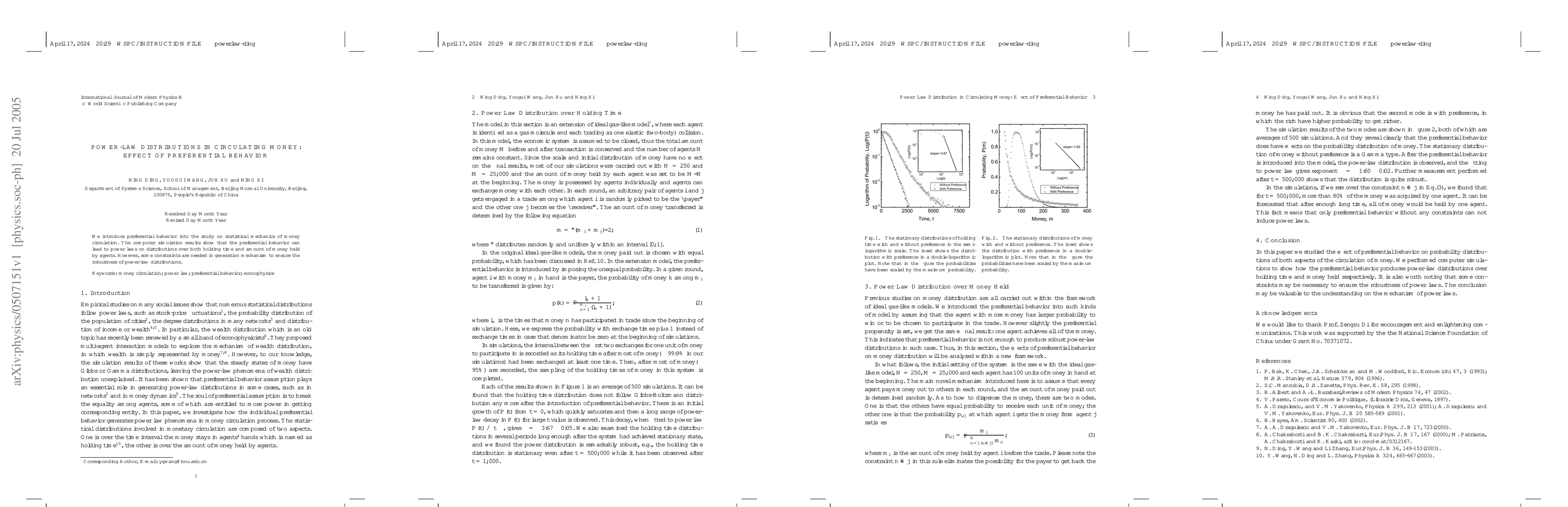

We introduce preferential behavior into the study on statistical mechanics of money circulation. The computer simulation results show that the preferential behavior can lead to power laws on distributions over both holding time and amount of money held by agents. However, some constraints are needed in generation mechanism to ensure the robustness of power-law distributions.

AI Key Findings

Generated Sep 03, 2025

Methodology

A computer simulation was used to study the statistical mechanics of money circulation with preferential behavior.

Key Results

- Power laws on distributions over holding time and amount of money held by agents were observed

- The preferential behavior led to the emergence of power-law distributions in both cases

- Constraints were needed in the generation mechanism to ensure robustness of power-law distributions

Significance

This research is important as it explores the impact of preferential behavior on money circulation and its potential effects on financial systems.

Technical Contribution

The introduction of preferential behavior into the study of statistical mechanics of money circulation led to the emergence of power-law distributions.

Novelty

This work is novel as it explores the impact of human behavior on financial systems and its potential effects on economic outcomes

Limitations

- The simulation was limited to a specific set of agents and scenarios

- The results may not be generalizable to all real-world financial systems

Future Work

- Investigating the impact of preferential behavior on other aspects of money circulation

- Developing more realistic models of agent behavior and interactions

- Examining the effects of preferential behavior on financial stability and risk management

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPreferential attachment and power-law degree distributions in heterogeneous multilayer hypergraphs

Francesco Di Lauro, Luca Ferretti

| Title | Authors | Year | Actions |

|---|

Comments (0)