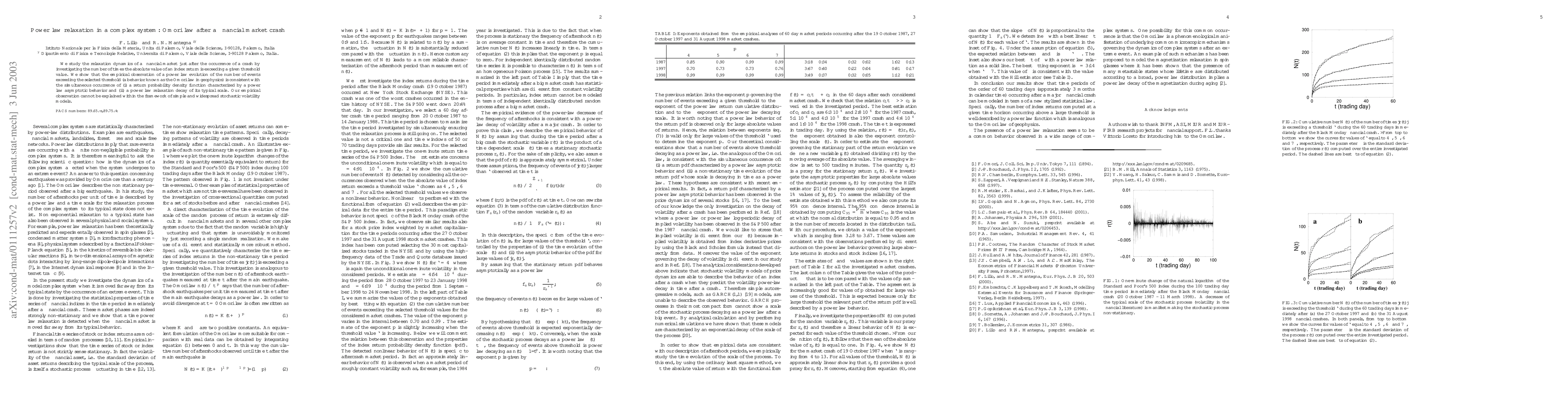

Summary

We study the relaxation dynamics of a financial market just after the occurrence of a crash by investigating the number of times the absolute value of an index return is exceeding a given threshold value. We show that the empirical observation of a power law evolution of the number of events exceeding the selected threshold (a behavior known as the Omori law in geophysics) is consistent with the simultaneous occurrence of (i) a return probability density function characterized by a power law asymptotic behavior and (ii) a power law relaxation decay of its typical scale. Our empirical observation cannot be explained within the framework of simple and widespread stochastic volatility models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)