Summary

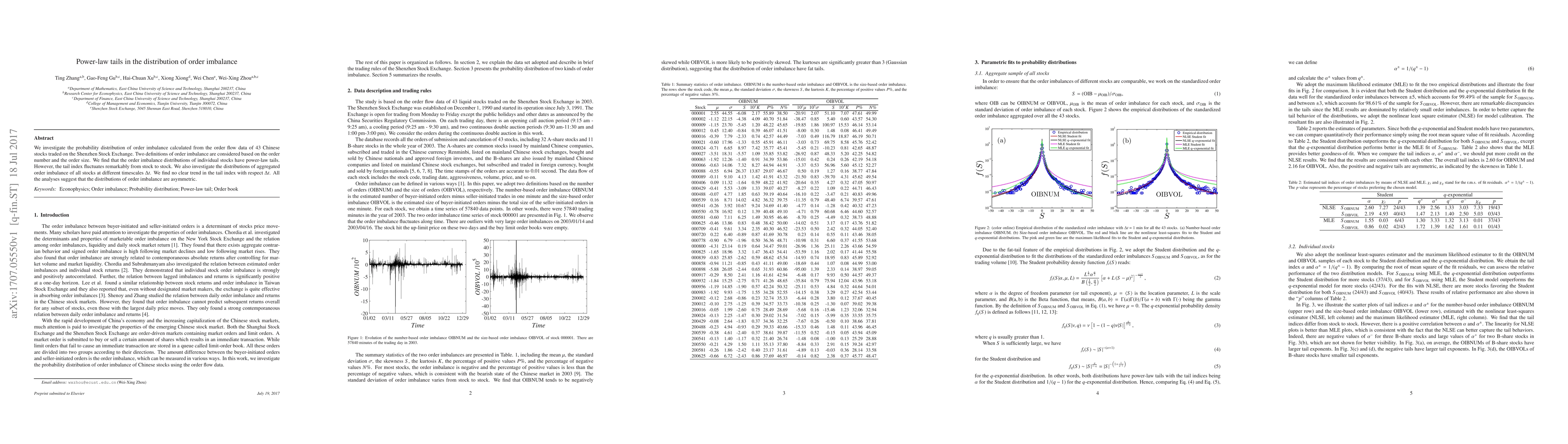

We investigate the probability distribution of order imbalance calculated from the order flow data of 43 Chinese stocks traded on the Shenzhen Stock Exchange. Two definitions of order imbalance are considered based on the order number and the order size. We find that the order imbalance distributions of individual stocks have power-law tails. However, the tail index fluctuates remarkably from stock to stock. We also investigate the distributions of aggregated order imbalance of all stocks at different timescales $\Delta{t}$. We find no clear trend in the tail index with respect $\Delta{t}$. All the analyses suggest that the distributions of order imbalance are asymmetric.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)