Summary

The growing penetration of renewable energy sources is expected to drive higher demand for power reserve ancillary services (AS). One solution is to increase the supply by integrating distributed energy resources (DERs) into the AS market through virtual power plants (VPPs). Several methods have been developed to assess the potential of VPPs to provide services. However, the existing approaches fail to account for AS products' requirements (reliability and technical specifications) and to provide accurate cost estimations. Here, we propose a new method to assess VPPs' potential to deliver power reserve capacity products under forecasting uncertainty. First, the maximum feasible reserve quantity is determined using a novel formulation of subset simulation for efficient uncertainty quantification. Second, the supply curve is characterized by considering explicit and opportunity costs. The method is applied to a VPP based on a representative Swiss low-voltage network with a diversified DER portfolio. We find that VPPs can reliably offer reserve products and that opportunity costs drive product pricing. Additionally, we show that the product's requirements strongly impact the reserve capacity provision capability. This approach aims to support VPP managers in developing market strategies and policymakers in designing DER-focused AS products.

AI Key Findings

Generated Oct 08, 2025

Methodology

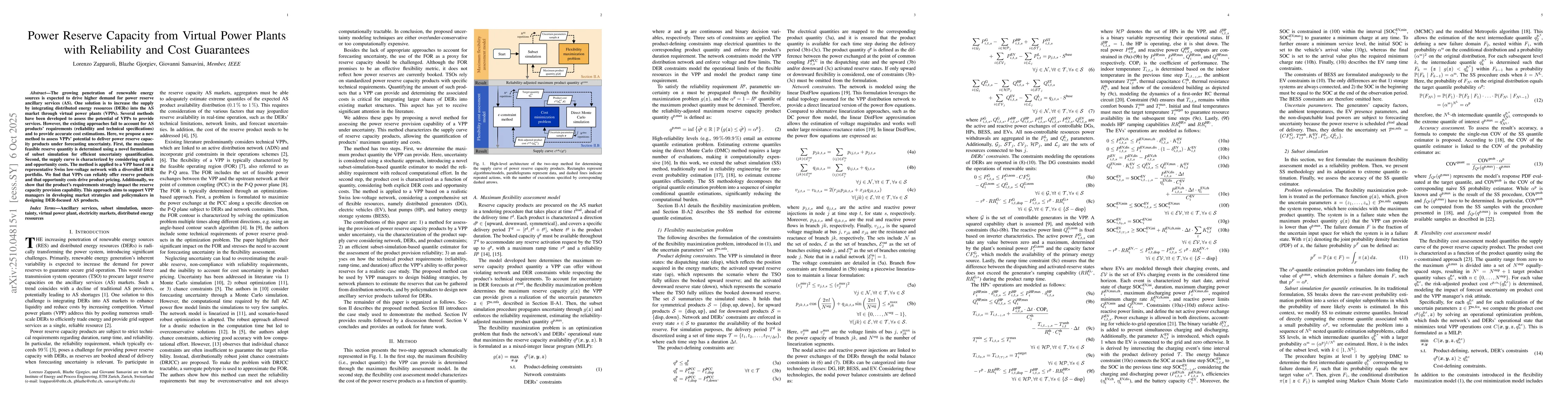

The research employs a two-step approach combining subset simulation for extreme quantile estimation and an epsilon-constrained method to model supply curves of reserve capacity products. It integrates uncertainty quantification with economic cost analysis for virtual power plants (VPPs).

Key Results

- The VPP supply curve is found to be monotonically non-decreasing with opportunity costs from energy market participation as the primary cost driver

- Maximum offerable product quantity strongly depends on technical requirements like reliability and duration

- The proposed SS-based quantile estimator improves computational efficiency by 69% compared to direct Monte Carlo methods

Significance

This research provides a framework for characterizing reserve capacity products under uncertainty, enabling better design of ancillary services and supporting higher renewable integration in power systems.

Technical Contribution

Develops a novel extreme quantile estimation technique based on subset simulation for uncertainty quantification in VPP operations, combined with an epsilon-constrained approach for supply curve modeling.

Novelty

Introduces a two-step methodology that simultaneously addresses both uncertainty quantification and economic cost analysis for reserve capacity products, providing a comprehensive framework for VPP operation under uncertainty.

Limitations

- Assumes static network conditions without dynamic load variations

- Limited to Swiss grid-specific parameters and market rules

Future Work

- Extend to larger networks with dynamic load profiles

- Apply to different market structures and regulatory frameworks

- Incorporate real-time pricing and demand response mechanisms

Paper Details

PDF Preview

Similar Papers

Found 4 papersOptimal Frequency Support from Virtual Power Plants: Minimal Reserve and Allocation

Xiang Zhu, Hua Geng, Guangchun Ruan

Dynamic Virtual Power Plants With Frequency Regulation Capacity

Xiang Zhu, Hua Geng, Guangchun Ruan

Comments (0)