Summary

In the context of stochastic volatility models, we study representation formulas in terms of expectations for the power series' coefficients associated to the call price-function. As in a recent paper by Antonelli and Scarlatti the expansion is done w.r.t. the correlation between the noises driving the underlying asset price process and the volatility process. We first obtain expressions for the power series' coefficients from the generalized Hull and White formula obtained by Elisa Al\`os. Afterwards, we provide representations turning out from the approach for the sensitivity problem tackled by Malliavin calculus techniques, and these allow to handle not only vanilla options. Finally, we show the numerical performance of the associated Monte Carlo estimators for several stochastic volatility models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

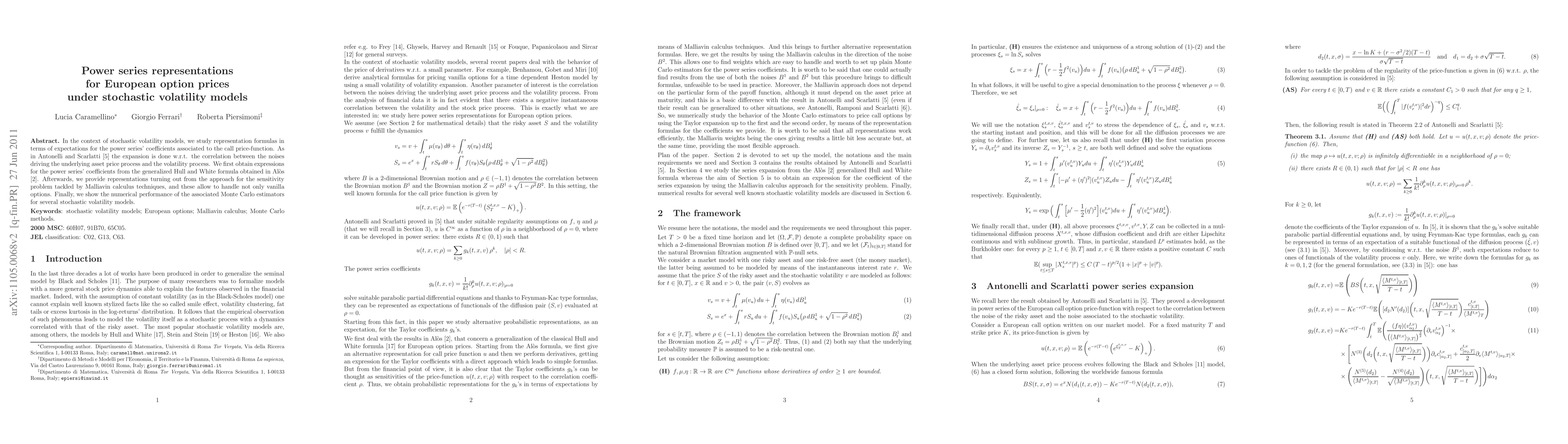

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)