Summary

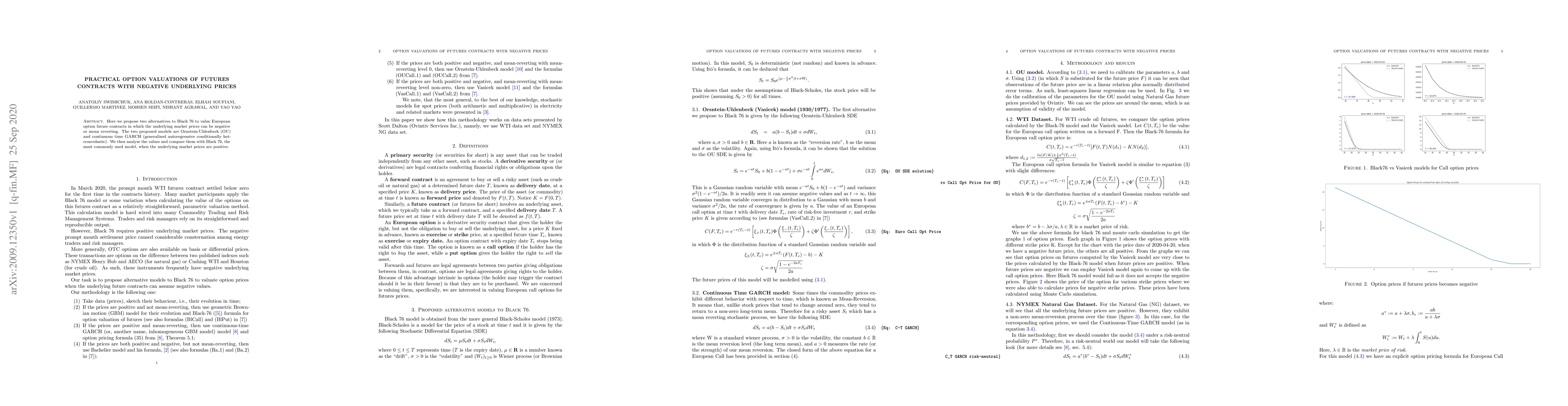

Here we propose two alternatives to Black 76 to value European option future contracts in which the underlying market prices can be negative or mean reverting. The two proposed models are Ornstein-Uhlenbeck (OU) and continuous time GARCH (generalized autoregressive conditionally heteroscedastic). We then analyse the values and compare them with Black 76, the most commonly used model, when the underlying market prices are positive

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersInterpolating commodity futures prices with Kriging

Andrea Pallavicini, Andrea Maran

No citations found for this paper.

Comments (0)