Summary

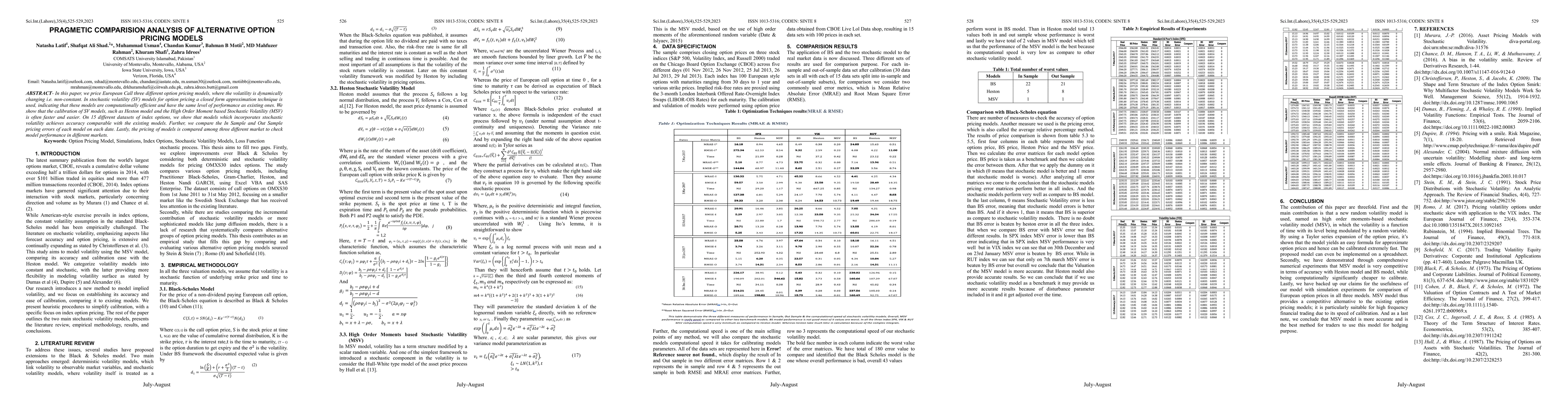

In this paper, we price European Call three different option pricing models, where the volatility is dynamically changing i.e. non constant. In stochastic volatility (SV) models for option pricing a closed form approximation technique is used, indicating that these models are computationally efficient and have the same level of performance as existing ones. We show that the calibration of SV models, such as Heston model and the High Order Moment based Stochastic Volatility (MSV) is often faster and easier. On 15 different datasets of index options, we show that models which incorporates stochastic volatility achieves accuracy comparable with the existing models. Further, we compare the In Sample and Out Sample pricing errors of each model on each date. Lastly, the pricing of models is compared among three different market to check model performance in different markets. Keywords: Option Pricing Model, Simulations, Index Options, Stochastic Volatility Models, Loss Function http://www.sci-int.com/pdf/638279543859822650.pdf

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Calibration With Artificial Neural Network: A Performance Comparison on Option Pricing Models

Jaehyung Choi, Young Shin Kim, Hyangju Kim

No citations found for this paper.

Comments (0)