Authors

Summary

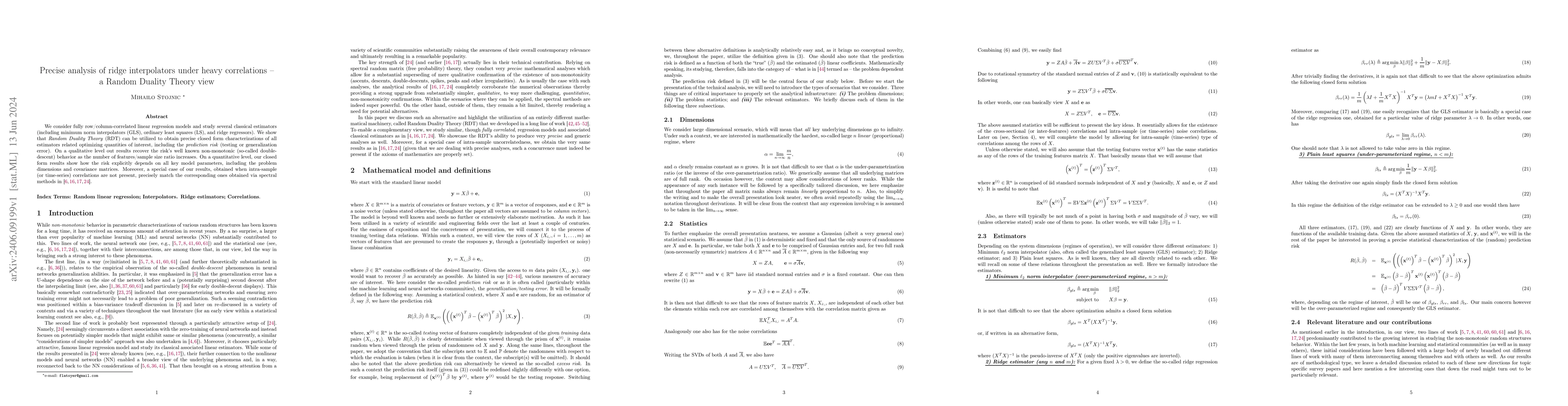

We consider fully row/column-correlated linear regression models and study several classical estimators (including minimum norm interpolators (GLS), ordinary least squares (LS), and ridge regressors). We show that \emph{Random Duality Theory} (RDT) can be utilized to obtain precise closed form characterizations of all estimators related optimizing quantities of interest, including the \emph{prediction risk} (testing or generalization error). On a qualitative level out results recover the risk's well known non-monotonic (so-called double-descent) behavior as the number of features/sample size ratio increases. On a quantitative level, our closed form results show how the risk explicitly depends on all key model parameters, including the problem dimensions and covariance matrices. Moreover, a special case of our results, obtained when intra-sample (or time-series) correlations are not present, precisely match the corresponding ones obtained via spectral methods in [6,16,17,24].

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)