Summary

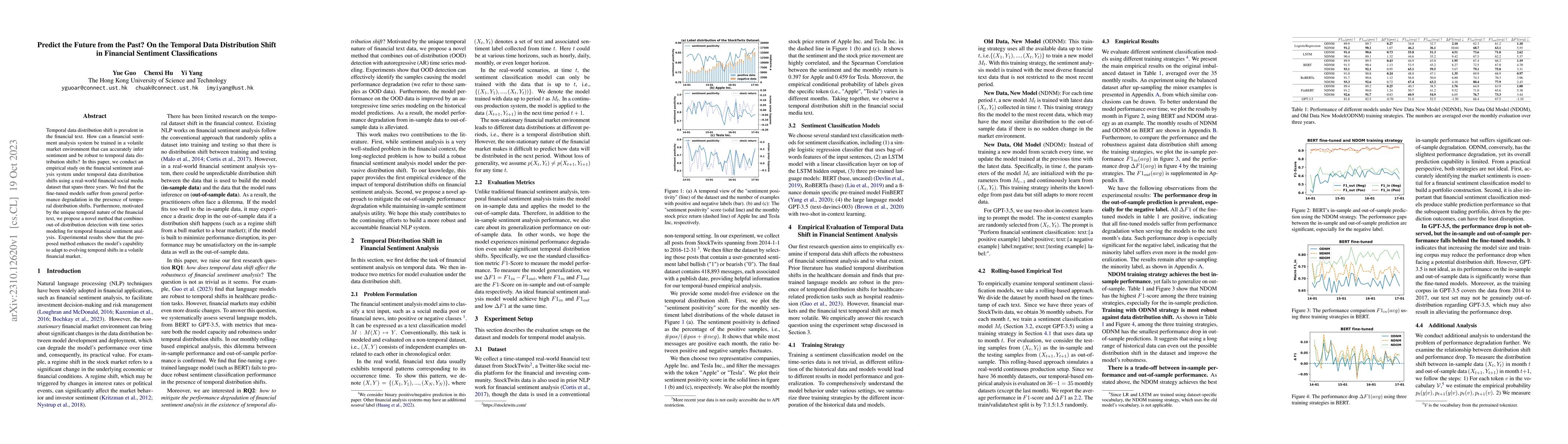

Temporal data distribution shift is prevalent in the financial text. How can a financial sentiment analysis system be trained in a volatile market environment that can accurately infer sentiment and be robust to temporal data distribution shifts? In this paper, we conduct an empirical study on the financial sentiment analysis system under temporal data distribution shifts using a real-world financial social media dataset that spans three years. We find that the fine-tuned models suffer from general performance degradation in the presence of temporal distribution shifts. Furthermore, motivated by the unique temporal nature of the financial text, we propose a novel method that combines out-of-distribution detection with time series modeling for temporal financial sentiment analysis. Experimental results show that the proposed method enhances the model's capability to adapt to evolving temporal shifts in a volatile financial market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersContextual Sentence Analysis for the Sentiment Prediction on Financial Data

Elvys Linhares Pontes, Mohamed Benjannet

| Title | Authors | Year | Actions |

|---|

Comments (0)