Authors

Summary

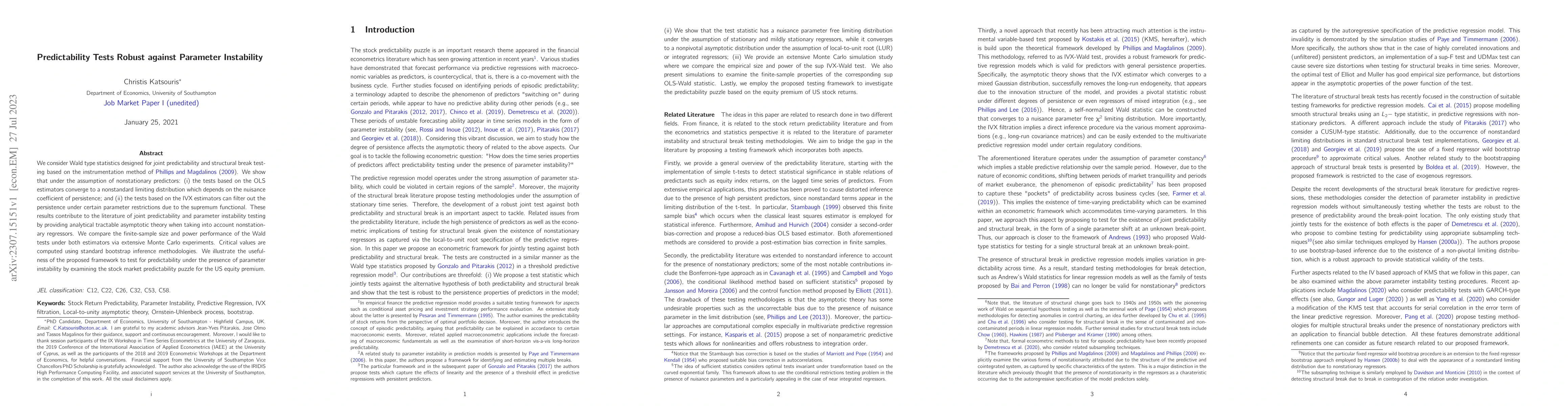

We consider Wald type statistics designed for joint predictability and structural break testing based on the instrumentation method of Phillips and Magdalinos (2009). We show that under the assumption of nonstationary predictors: (i) the tests based on the OLS estimators converge to a nonstandard limiting distribution which depends on the nuisance coefficient of persistence; and (ii) the tests based on the IVX estimators can filter out the persistence under certain parameter restrictions due to the supremum functional. These results contribute to the literature of joint predictability and parameter instability testing by providing analytical tractable asymptotic theory when taking into account nonstationary regressors. We compare the finite-sample size and power performance of the Wald tests under both estimators via extensive Monte Carlo experiments. Critical values are computed using standard bootstrap inference methodologies. We illustrate the usefulness of the proposed framework to test for predictability under the presence of parameter instability by examining the stock market predictability puzzle for the US equity premium.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPredictability Awareness for Efficient and Robust Multi-Agent Coordination

Khaled A. Mustafa, Daniel Jarne Ornia, Roman Chiva Gil et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)