Summary

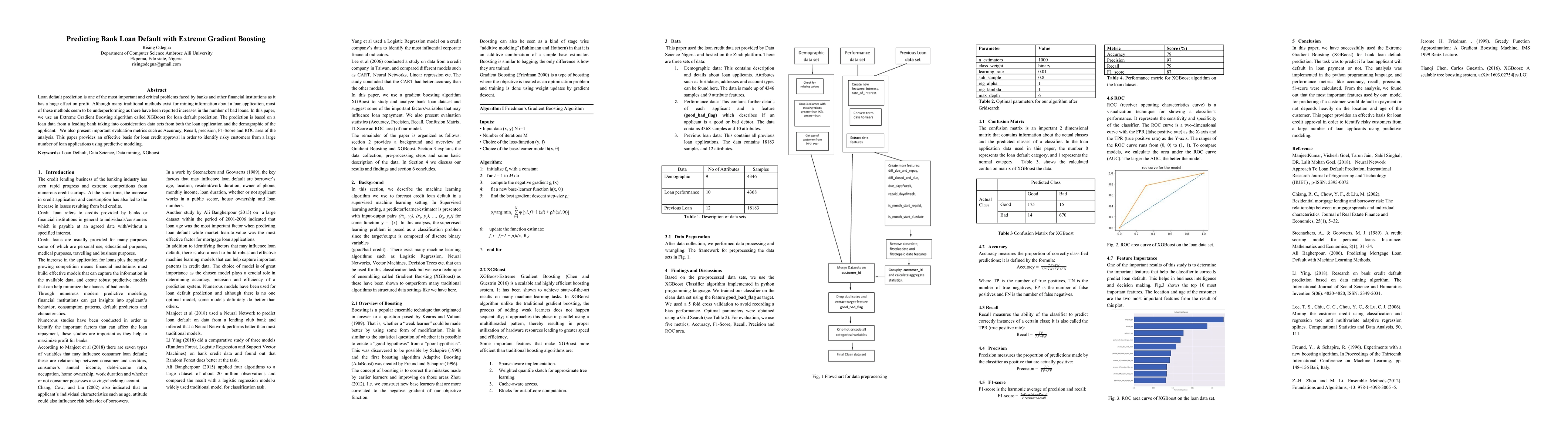

Loan default prediction is one of the most important and critical problems faced by banks and other financial institutions as it has a huge effect on profit. Although many traditional methods exist for mining information about a loan application, most of these methods seem to be under-performing as there have been reported increases in the number of bad loans. In this paper, we use an Extreme Gradient Boosting algorithm called XGBoost for loan default prediction. The prediction is based on a loan data from a leading bank taking into consideration data sets from both the loan application and the demographic of the applicant. We also present important evaluation metrics such as Accuracy, Recall, precision, F1-Score and ROC area of the analysis. This paper provides an effective basis for loan credit approval in order to identify risky customers from a large number of loan applications using predictive modeling.

AI Key Findings

Generated Sep 07, 2025

Methodology

The research employs the XGBoost algorithm, a gradient boosting technique, to predict bank loan defaults using a dataset from a leading bank. The dataset includes both loan application and applicant demographic information. The study evaluates the model using metrics such as Accuracy, Recall, Precision, F1-Score, and ROC area.

Key Results

- XGBoost model achieved an accuracy of 79% in predicting loan defaults.

- Location and age of the customer were identified as the most important features influencing loan default prediction.

- The model's F1-score was 87%, indicating a good balance between precision and recall.

Significance

This research provides an effective basis for loan credit approval by identifying risky customers from numerous loan applications using predictive modeling, potentially reducing bad loans and increasing profitability for financial institutions.

Technical Contribution

The paper demonstrates the successful application of XGBoost for bank loan default prediction, showcasing its efficiency and accuracy in handling structured data.

Novelty

While traditional methods for loan default prediction have shown limitations, this research leverages the XGBoost algorithm, which has been proven to outperform many traditional algorithms in similar settings.

Limitations

- The study did not discuss the generalizability of the model to other bank datasets or geographical regions.

- No comparison was made with other state-of-the-art machine learning algorithms for loan default prediction.

Future Work

- Investigate the model's performance on datasets from different banks and regions.

- Compare XGBoost's performance with other advanced machine learning algorithms for loan default prediction.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBank Loan Prediction Using Machine Learning Techniques

Md. Mahedi Hassan, F M Ahosanul Haque

Gradient boosting for extreme quantile regression

Clément Dombry, Sebastian Engelke, Jasper Velthoen et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)