Summary

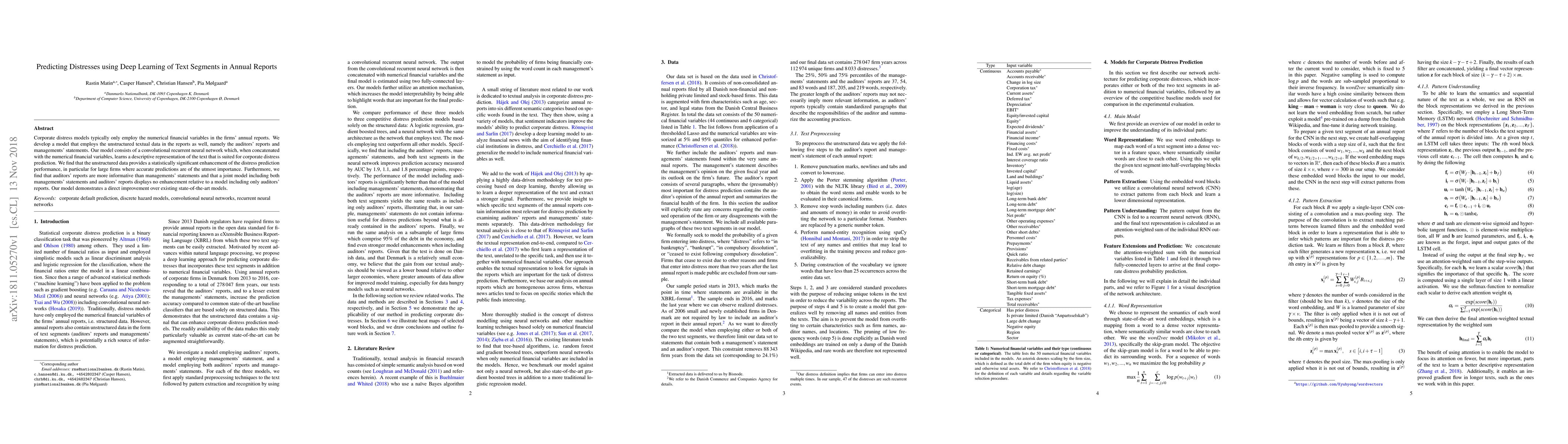

Corporate distress models typically only employ the numerical financial variables in the firms' annual reports. We develop a model that employs the unstructured textual data in the reports as well, namely the auditors' reports and managements' statements. Our model consists of a convolutional recurrent neural network which, when concatenated with the numerical financial variables, learns a descriptive representation of the text that is suited for corporate distress prediction. We find that the unstructured data provides a statistically significant enhancement of the distress prediction performance, in particular for large firms where accurate predictions are of the utmost importance. Furthermore, we find that auditors' reports are more informative than managements' statements and that a joint model including both managements' statements and auditors' reports displays no enhancement relative to a model including only auditors' reports. Our model demonstrates a direct improvement over existing state-of-the-art models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMulti-Task Learning for Features Extraction in Financial Annual Reports

Senja Pollak, Syrielle Montariol, Boshko Koloski et al.

Multi-Label Annotation of Chest Abdomen Pelvis Computed Tomography Text Reports Using Deep Learning

Maciej A. Mazurowski, Fakrul Islam Tushar, Joseph Y. Lo et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)