Summary

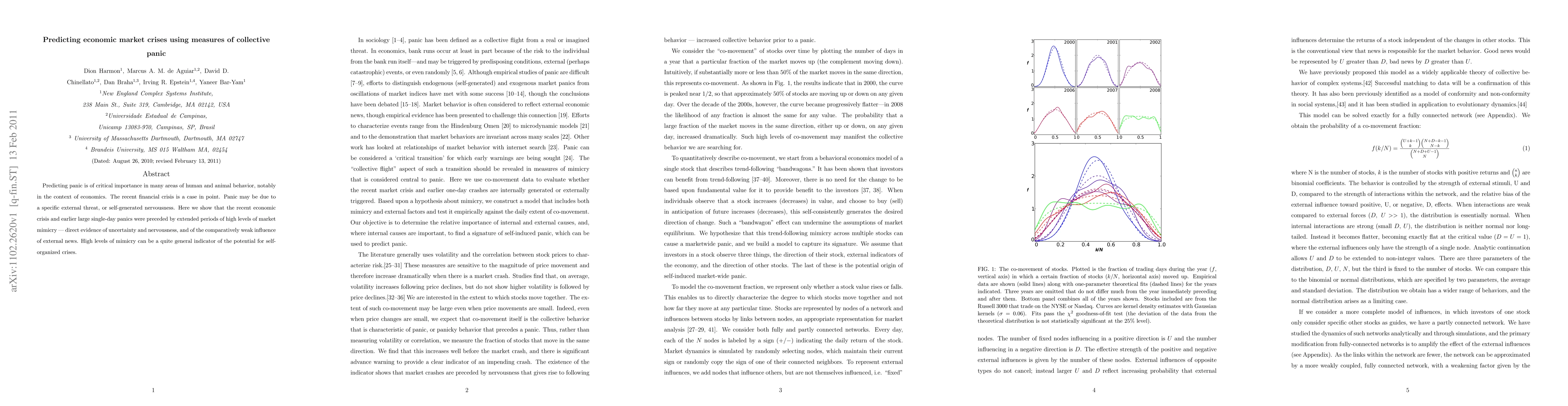

Predicting panic is of critical importance in many areas of human and animal behavior, notably in the context of economics. The recent financial crisis is a case in point. Panic may be due to a specific external threat, or self-generated nervousness. Here we show that the recent economic crisis and earlier large single-day panics were preceded by extended periods of high levels of market mimicry --- direct evidence of uncertainty and nervousness, and of the comparatively weak influence of external news. High levels of mimicry can be a quite general indicator of the potential for self-organized crises.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPredicting Financial Market Crises using Multilayer Network Analysis and LSTM-based Forecasting of Spillover Effects

Mahdi Kohan Sefidi

Multidimensional Economic Complexity and Fiscal Crises

Viktor Stojkoski, Goran Hristovski, Gjorgji Gockov

| Title | Authors | Year | Actions |

|---|

Comments (0)