Authors

Summary

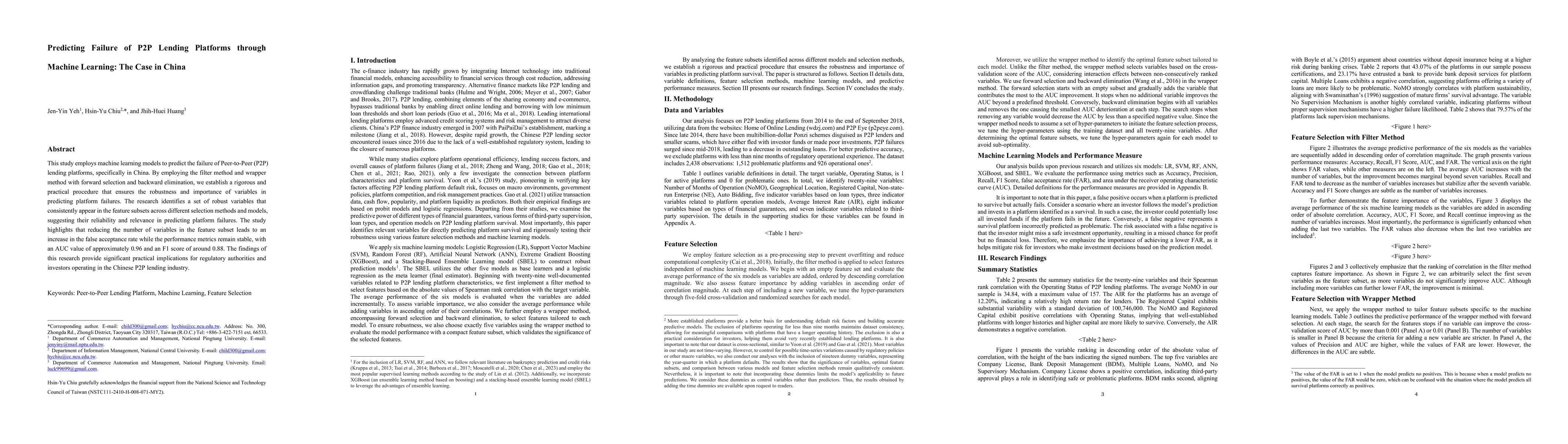

This study employs machine learning models to predict the failure of Peer-to-Peer (P2P) lending platforms, specifically in China. By employing the filter method and wrapper method with forward selection and backward elimination, we establish a rigorous and practical procedure that ensures the robustness and importance of variables in predicting platform failures. The research identifies a set of robust variables that consistently appear in the feature subsets across different selection methods and models, suggesting their reliability and relevance in predicting platform failures. The study highlights that reducing the number of variables in the feature subset leads to an increase in the false acceptance rate while the performance metrics remain stable, with an AUC value of approximately 0.96 and an F1 score of around 0.88. The findings of this research provide significant practical implications for regulatory authorities and investors operating in the Chinese P2P lending industry.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCredit Risk Meets Large Language Models: Building a Risk Indicator from Loan Descriptions in P2P Lending

Mario Sanz-Guerrero, Javier Arroyo

| Title | Authors | Year | Actions |

|---|

Comments (0)