Summary

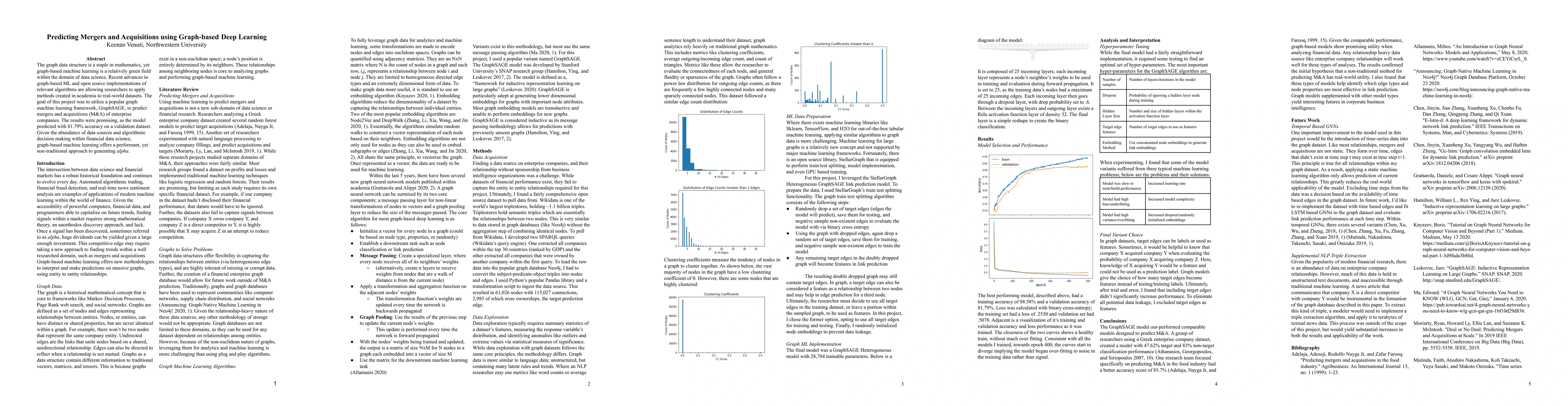

The graph data structure is a staple in mathematics, yet graph-based machine learning is a relatively green field within the domain of data science. Recent advances in graph-based ML and open source implementations of relevant algorithms are allowing researchers to apply methods created in academia to real-world datasets. The goal of this project was to utilize a popular graph machine learning framework, GraphSAGE, to predict mergers and acquisitions (M&A) of enterprise companies. The results were promising, as the model predicted with 81.79% accuracy on a validation dataset. Given the abundance of data sources and algorithmic decision making within financial data science, graph-based machine learning offers a performant, yet non-traditional approach to generating alpha.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrediction and visualization of Mergers and Acquisitions using Economic Complexity

Andrea Zaccaria, Matteo Straccamore, Lorenzo Arsini

Graph Neural Networks Based Deep Learning for Predicting Structural and Electronic Properties

Selva Chandrasekaran Selvaraj

| Title | Authors | Year | Actions |

|---|

Comments (0)