Summary

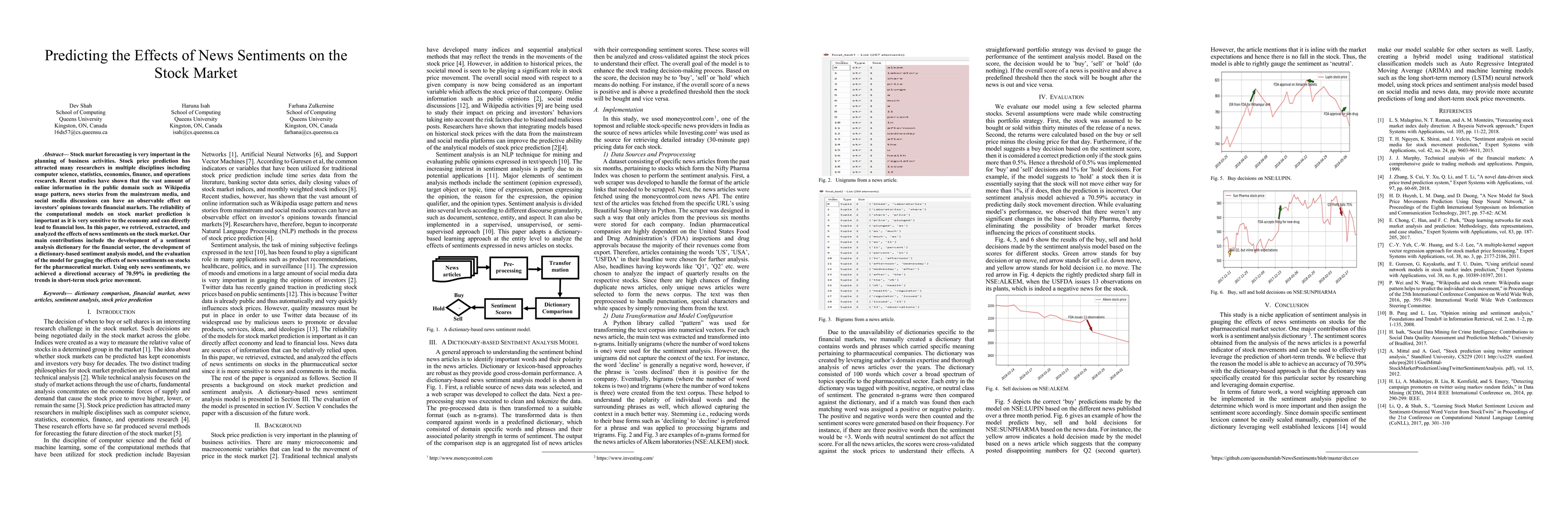

Stock market forecasting is very important in the planning of business activities. Stock price prediction has attracted many researchers in multiple disciplines including computer science, statistics, economics, finance, and operations research. Recent studies have shown that the vast amount of online information in the public domain such as Wikipedia usage pattern, news stories from the mainstream media, and social media discussions can have an observable effect on investors opinions towards financial markets. The reliability of the computational models on stock market prediction is important as it is very sensitive to the economy and can directly lead to financial loss. In this paper, we retrieved, extracted, and analyzed the effects of news sentiments on the stock market. Our main contributions include the development of a sentiment analysis dictionary for the financial sector, the development of a dictionary-based sentiment analysis model, and the evaluation of the model for gauging the effects of news sentiments on stocks for the pharmaceutical market. Using only news sentiments, we achieved a directional accuracy of 70.59% in predicting the trends in short-term stock price movement.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEffects of Daily News Sentiment on Stock Price Forecasting

A. Das, S. Srinivas, R. Gadela et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)