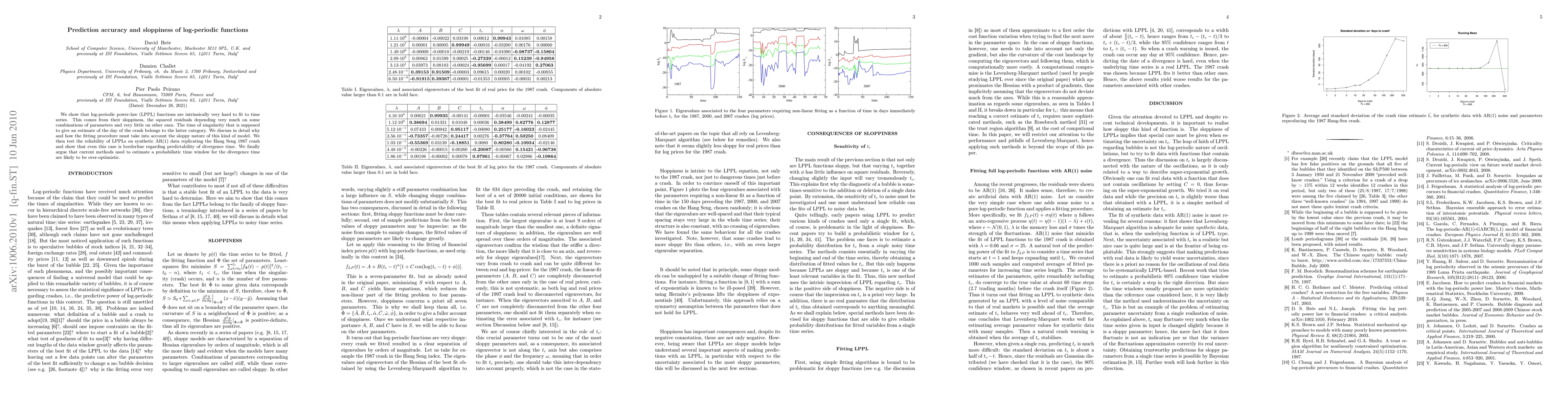

Summary

We show that log-periodic power-law (LPPL) functions are intrinsically very hard to fit to time series. This comes from their sloppiness, the squared residuals depending very much on some combinations of parameters and very little on other ones. The time of singularity that is supposed to give an estimate of the day of the crash belongs to the latter category. We discuss in detail why and how the fitting procedure must take into account the sloppy nature of this kind of model. We then test the reliability of LPPLs on synthetic AR(1) data replicating the Hang Seng 1987 crash and show that even this case is borderline regarding predictability of divergence time. We finally argue that current methods used to estimate a probabilistic time window for the divergence time are likely to be over-optimistic.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)