Summary

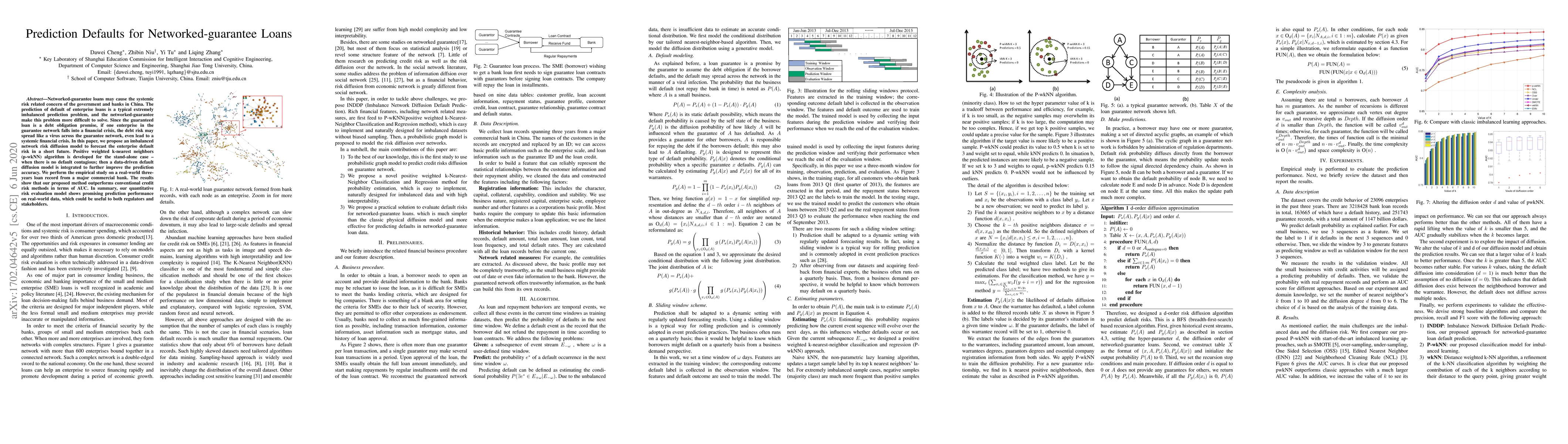

Networked-guarantee loans may cause the systemic risk related concern of the government and banks in China. The prediction of default of enterprise loans is a typical extremely imbalanced prediction problem, and the networked-guarantee make this problem more difficult to solve. Since the guaranteed loan is a debt obligation promise, if one enterprise in the guarantee network falls into a financial crisis, the debt risk may spread like a virus across the guarantee network, even lead to a systemic financial crisis. In this paper, we propose an imbalanced network risk diffusion model to forecast the enterprise default risk in a short future. Positive weighted k-nearest neighbors (p-wkNN) algorithm is developed for the stand-alone case -- when there is no default contagious; then a data-driven default diffusion model is integrated to further improve the prediction accuracy. We perform the empirical study on a real-world three-years loan record from a major commercial bank. The results show that our proposed method outperforms conventional credit risk methods in terms of AUC. In summary, our quantitative risk evaluation model shows promising prediction performance on real-world data, which could be useful to both regulators and stakeholders.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)