Authors

Summary

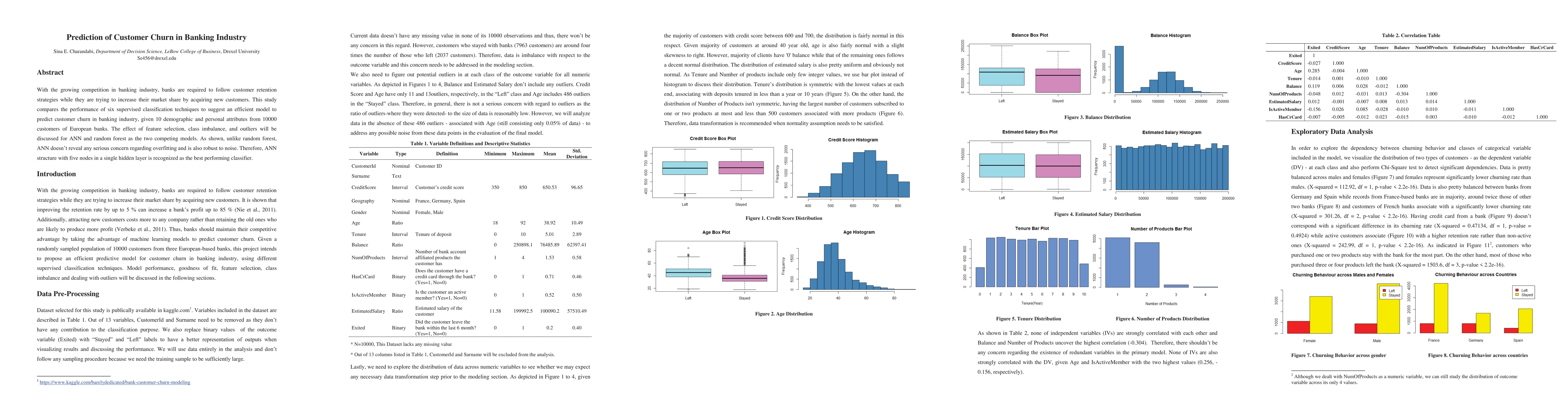

With the growing competition in banking industry, banks are required to follow customer retention strategies while they are trying to increase their market share by acquiring new customers. This study compares the performance of six supervised classification techniques to suggest an efficient model to predict customer churn in banking industry, given 10 demographic and personal attributes from 10000 customers of European banks. The effect of feature selection, class imbalance, and outliers will be discussed for ANN and random forest as the two competing models. As shown, unlike random forest, ANN does not reveal any serious concern regarding overfitting and is also robust to noise. Therefore, ANN structure with five nodes in a single hidden layer is recognized as the best performing classifier.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrivacy-Preserving Customer Churn Prediction Model in the Context of Telecommunication Industry

M Saifur Rahman, Joydeb Kumar Sana, M Sohel Rahman

Data transformation based optimized customer churn prediction model for the telecommunication industry

M. Sohel Rahman, Joydeb Kumar Sana, Mohammad Zoynul Abedin et al.

Modelling customer lifetime-value in the retail banking industry

Salvatore Mercuri, Raad Khraishi, Greig Cowan

| Title | Authors | Year | Actions |

|---|

Comments (0)