Authors

Summary

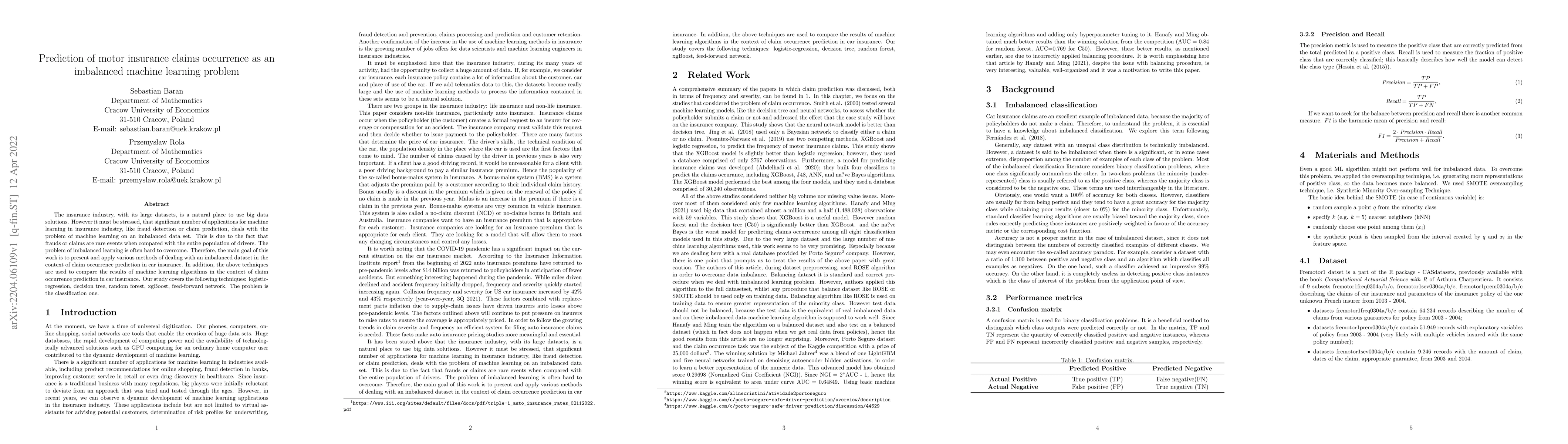

The insurance industry, with its large datasets, is a natural place to use big data solutions. However it must be stressed, that significant number of applications for machine learning in insurance industry, like fraud detection or claim prediction, deals with the problem of machine learning on an imbalanced data set. This is due to the fact that frauds or claims are rare events when compared with the entire population of drivers. The problem of imbalanced learning is often hard to overcome. Therefore, the main goal of this work is to present and apply various methods of dealing with an imbalanced dataset in the context of claim occurrence prediction in car insurance. In addition, the above techniques are used to compare the results of machine learning algorithms in the context of claim occurrence prediction in car insurance. Our study covers the following techniques: logistic-regression, decision tree, random forest, xgBoost, feed-forward network. The problem is the classification one.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTree-Based Machine Learning Methods For Vehicle Insurance Claims Size Prediction

Edossa Merga Terefe

Machine Learning For An Explainable Cost Prediction of Medical Insurance

Ugochukwu Orji, Elochukwu Ukwandu

Modeling Insurance Claims using Bayesian Nonparametric Regression

Kaushik Ghosh, Mostafa Shams Esfand Abadi

| Title | Authors | Year | Actions |

|---|

Comments (0)