Authors

Summary

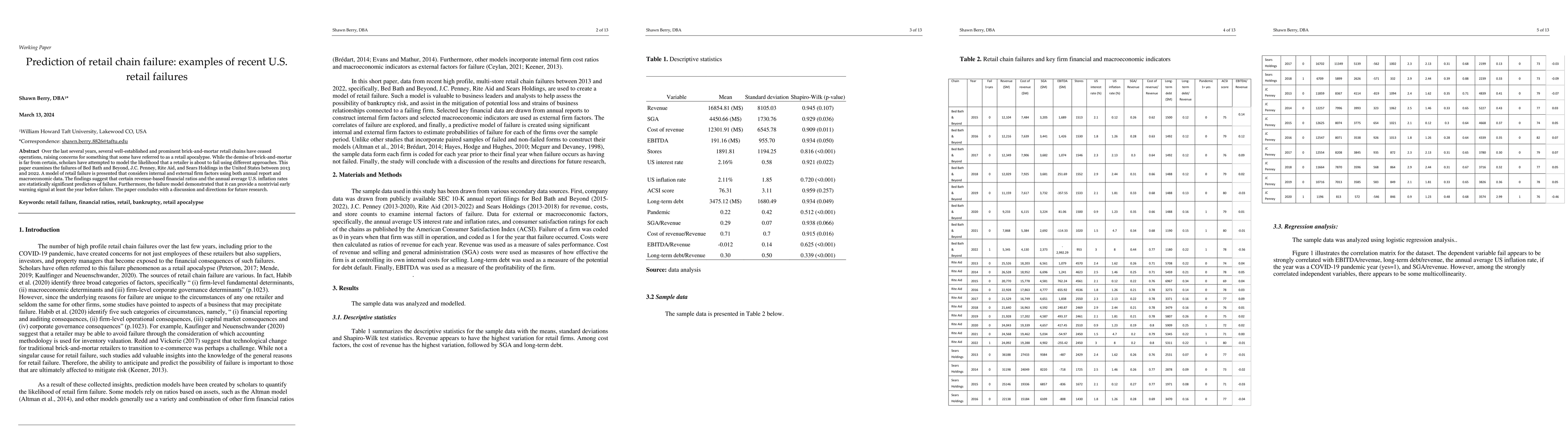

Over the last several years, several well-established and prominent brick-and-mortar retail chains have ceased operations, raising concerns for something that some have referred to as a retail apocalypse. While the demise of brick-and-mortar is far from certain, scholars have attempted to model the likelihood that a retailer is about to fail using different approaches. This paper examines the failures of Bed Bath and Beyond, J.C. Penney, Rite Aid, and Sears Holdings in the United States between 2013 and 2022. A model of retail failure is presented that considers internal and external firm factors using both annual report and macroeconomic data. The findings suggest that certain revenue-based financial ratios and the annual average U.S. inflation rates are statistically significant predictors of failure. Furthermore, the failure model demonstrated that it can provide a nontrivial early warning signal at least the year before failure. The paper concludes with a discussion and directions for future research.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPivoting Retail Supply Chain with Deep Generative Techniques: Taxonomy, Survey and Insights

Yuan Wang, Lokesh Kumar Sambasivan, Mingang Fu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)