Authors

Summary

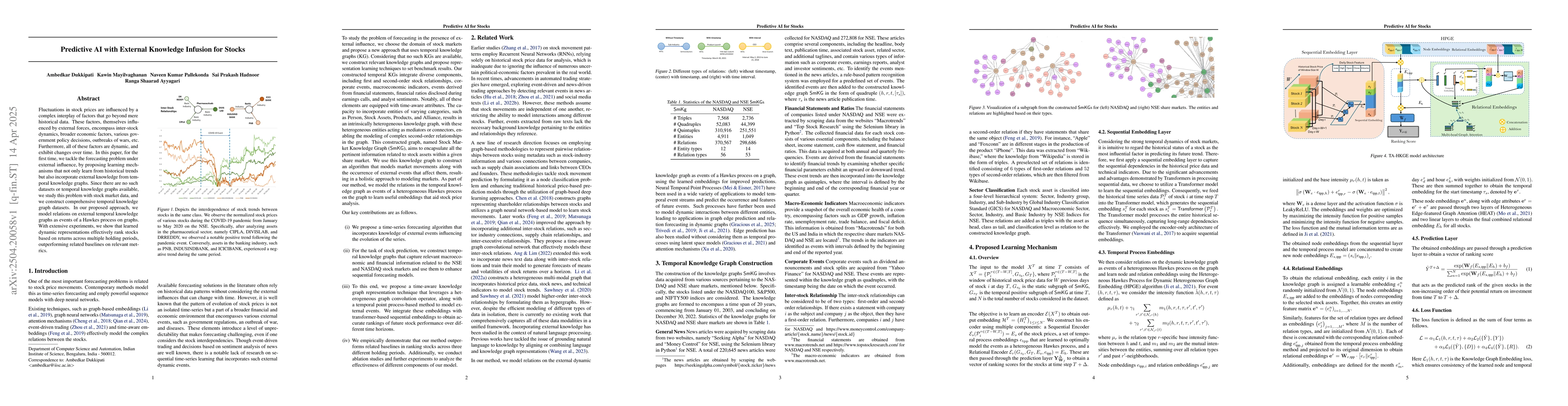

Fluctuations in stock prices are influenced by a complex interplay of factors that go beyond mere historical data. These factors, themselves influenced by external forces, encompass inter-stock dynamics, broader economic factors, various government policy decisions, outbreaks of wars, etc. Furthermore, all of these factors are dynamic and exhibit changes over time. In this paper, for the first time, we tackle the forecasting problem under external influence by proposing learning mechanisms that not only learn from historical trends but also incorporate external knowledge from temporal knowledge graphs. Since there are no such datasets or temporal knowledge graphs available, we study this problem with stock market data, and we construct comprehensive temporal knowledge graph datasets. In our proposed approach, we model relations on external temporal knowledge graphs as events of a Hawkes process on graphs. With extensive experiments, we show that learned dynamic representations effectively rank stocks based on returns across multiple holding periods, outperforming related baselines on relevant metrics.

AI Key Findings

Generated Jun 09, 2025

Methodology

The research proposes a novel approach, TA-HKGE, that integrates heterogeneous graph attention networks, temporal process models, and time-aware translation-based knowledge graph embedding techniques to forecast stock prices using external knowledge in the form of temporal knowledge graphs.

Key Results

- The proposed model, TA-HKGE, outperforms baseline models in stock ranking based on relevant metrics such as Top1, Top5, IRRA, IRRR, SR, NDCG, and ACC.

- Empirical demonstration of the validity and effectiveness of the proposed methods on the task of stock ranking.

- The study introduces Stock Market Knowledge Graphs (SmKG) to provide a systematic framework for constructing knowledge graphs encompassing comprehensive information about publicly available share market data.

- The model's performance is shown to be robust across different datasets (NASDAQ100, S&P500, NIFTY500) and holding periods (daily, weekly, monthly).

Significance

This research contributes to the field of stock market analysis by providing a comprehensive and efficient framework to solve a forecasting problem by incorporating external knowledge through temporal knowledge graphs, which can potentially enhance investment decision-making processes.

Technical Contribution

The paper introduces a novel model, TA-HKGE, that leverages heterogeneous graph attention networks, temporal process models, and time-aware translation-based knowledge graph embedding techniques for stock price forecasting.

Novelty

This work is novel as it is the first to address the problem of forecasting under external influence by proposing learning mechanisms that incorporate external knowledge from temporal knowledge graphs, thereby providing a more holistic view of stock market dynamics.

Limitations

- The study is limited by the absence of publicly available temporal knowledge graph datasets for stock markets, necessitating the construction of custom datasets.

- The model's performance heavily relies on the quality and comprehensiveness of the constructed knowledge graphs.

Future Work

- Exploration of additional external knowledge sources to enrich the temporal knowledge graphs.

- Investigation into the model's performance with real-time data and its applicability in live trading scenarios.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUnsupervised Knowledge Graph Construction and Event-centric Knowledge Infusion for Scientific NLI

Xiaodong Wang, Xiaowei Xu, Guodong Long et al.

Collaborative Knowledge Infusion for Low-resource Stance Detection

Ming Yan, Joey Tianyi Zhou, Ivor W. Tsang

Efficient Knowledge Infusion via KG-LLM Alignment

Zhiqiang Zhang, Jun Xu, Mengshu Sun et al.

No citations found for this paper.

Comments (0)