Authors

Summary

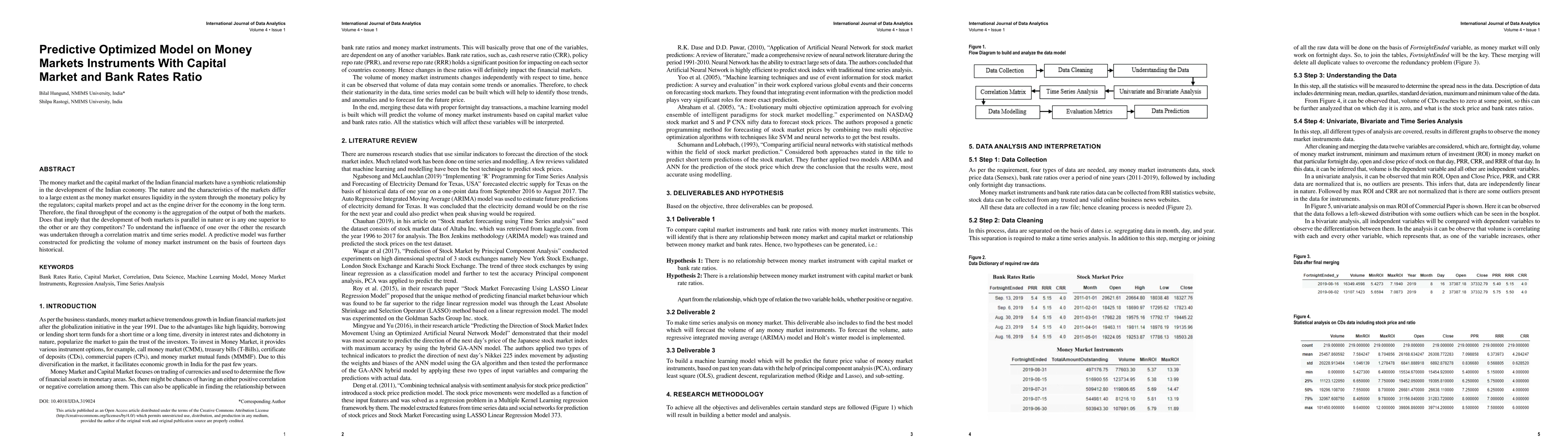

The money market and the capital market of the Indian financial markets have a symbiotic relationship in the development of the Indian economy. The nature and the characteristics of the markets differ to a large extent as the money market ensures liquidity in the system through the monetary policy by the regulators; capital markets propel and act as the engine driver for the economy in the long term. Therefore, the final throughput of the economy is the aggregation of the output of both the markets. Does that imply that the development of both markets is parallel in nature or is any one superior to the other or are they competitors? To understand the influence of one over the other the research was undertaken through a correlation matrix and time series model. A predictive model was further constructed for predicting the volume of money market instrument on the basis of fourteen days historical.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)