Summary

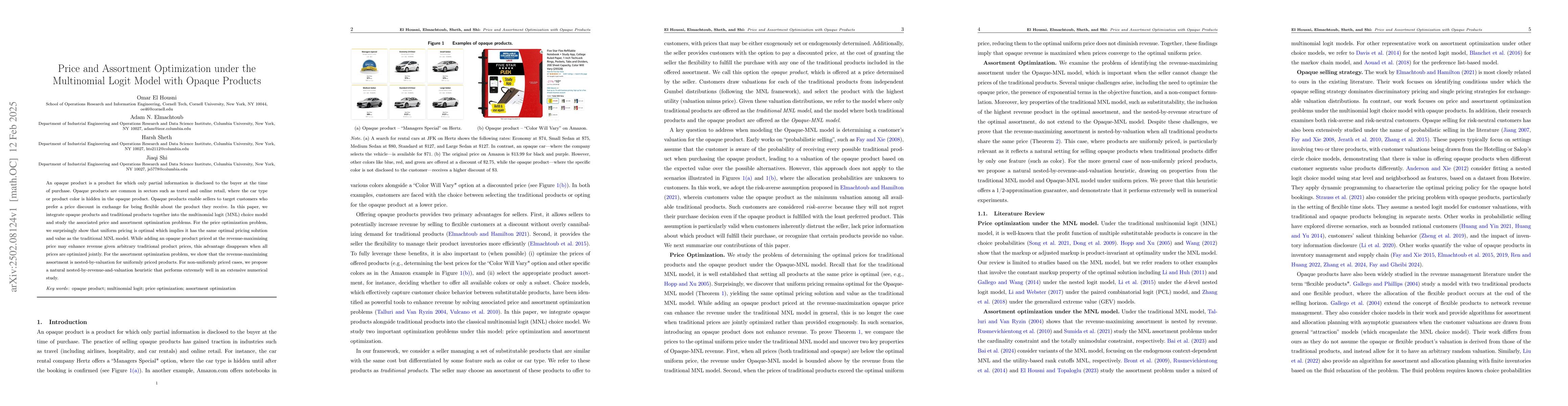

An opaque product is a product for which only partial information is disclosed to the buyer at the time of purchase. Opaque products are common in sectors such as travel and online retail, where the car type or product color is hidden in the opaque product. Opaque products enable sellers to target customers who prefer a price discount in exchange for being flexible about the product they receive. In this paper, we integrate opaque products and traditional products together into the multinomial logit (MNL) choice model and study the associated price and assortment optimization problems. For the price optimization problem, we surprisingly show that uniform pricing is optimal which implies it has the same optimal pricing solution and value as the traditional MNL model. While adding an opaque product priced at the revenue-maximizing price may enhance revenue given arbitrary traditional product prices, this advantage disappears when all prices are optimized jointly. For the assortment optimization problem, we show that the revenue-maximizing assortment is nested-by-valuation for uniformly priced products. For non-uniformly priced cases, we propose a natural nested-by-revenue-and-valuation heuristic that performs extremely well in an extensive numerical study.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research integrates opaque products into the traditional Multinomial Logit (MNL) choice model, analyzing price and assortment optimization problems with risk-averse customers.

Key Results

- Uniform pricing is optimal, implying that adding an opaque product does not enhance revenue when prices are jointly optimized.

- For uniformly priced products, the revenue-maximizing assortment is nested-by-valuation.

- For non-uniformly priced cases, a nested-by-revenue-and-valuation heuristic performs well in numerical studies.

Significance

This work provides insights into pricing strategies and assortment optimization for sectors like travel and online retail, where opaque products are common, potentially guiding businesses to maximize revenue.

Technical Contribution

The paper establishes that uniform pricing is optimal for opaque products under the MNL model, and proposes a nested-by-revenue-and-valuation heuristic for assortment optimization with general prices.

Novelty

The research distinguishes itself by proving optimality of uniform pricing for opaque products and by proposing a novel heuristic that performs well empirically, addressing a gap in the literature on assortment optimization with opaque products.

Limitations

- The study assumes risk-averse customers and does not explore the impact of risk-neutral customers.

- The findings may not generalize to contexts with costs or different valuation paradigms.

- The NRV heuristic, while effective, lacks strong theoretical guarantees for general prices.

Future Work

- Investigate the optimal pricing and assortment strategies for risk-neutral customers.

- Extend the model to include costs and explore different valuation paradigms.

- Develop new heuristics with stronger performance guarantees or characterize the optimal assortment policy for risk-averse customers.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAssortment Optimization under the Multinomial Logit Model with Covering Constraints

Qing Feng, Omar El Housni, Huseyin Topaloglu

No citations found for this paper.

Comments (0)