Summary

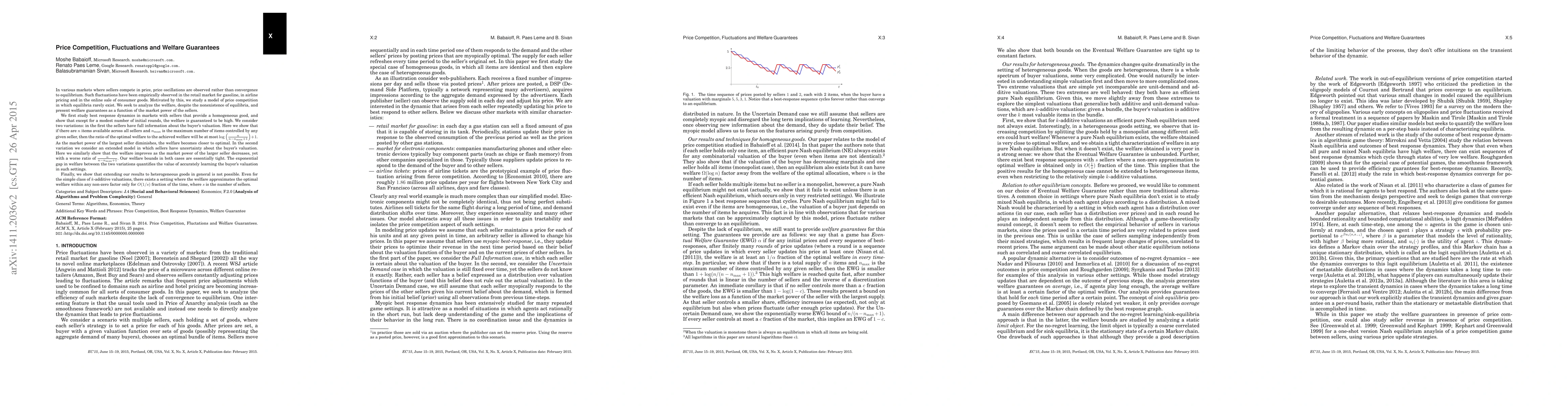

In various markets where sellers compete in price, price oscillations are observed rather than convergence to equilibrium. Such fluctuations have been empirically observed in the retail market for gasoline, in airline pricing and in the online sale of consumer goods. Motivated by this, we study a model of price competition in which an equilibrium rarely exists. We seek to analyze the welfare, despite the nonexistence of an equilibrium, and present welfare guarantees as a function of the market power of the sellers. We first study best response dynamics in markets with sellers that provide a homogeneous good, and show that except for a modest number of initial rounds, the welfare is guaranteed to be high. We consider two variations: in the first the sellers have full information about the valuation of the buyer. Here we show that if there are $n$ items available across all sellers and $n_{\max}$ is the maximum number of items controlled by any given seller, the ratio of the optimal welfare to the achieved welfare will be at most $\log(\frac{n}{n-n_{\max}+1})+1$. As the market power of the largest seller diminishes, the welfare becomes closer to optimal. In the second variation we consider an extended model where sellers have uncertainty about the buyer's valuation. Here we similarly show that the welfare improves as the market power of the largest seller decreases, yet with a worse ratio of $\frac{n}{n-n_{\max}+1}$. The exponential gap in welfare between the two variations quantifies the value of accurately learning the buyer valuation. Finally, we show that extending our results to heterogeneous goods in general is not possible. Even for the simple class of $k$-additive valuations, there exists a setting where the welfare approximates the optimal welfare within any non-zero factor only for $O(1/s)$ fraction of the time, where $s$ is the number of sellers.

AI Key Findings - Failed

Key findings generation failed. Failed to start generation process

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFrictions and Welfare in Monopolistic Competition

Francesco Del Prato, Paolo Zacchia

| Title | Authors | Year | Actions |

|---|

Comments (0)