Authors

Summary

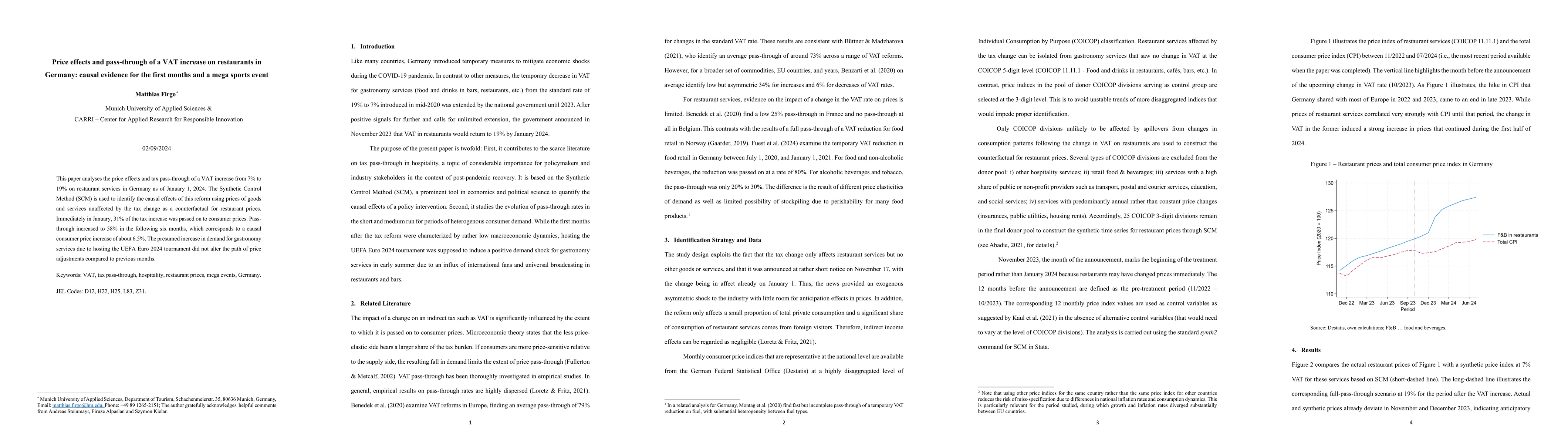

This paper analyses the price effects and tax pass-through of a VAT increase from 7% to 19% on restaurant services in Germany as of January 1, 2024. The Synthetic Control Method (SCM) is used to identify the causal effects of this reform using prices of goods and services unaffected by the tax change as a counterfactual for restaurant prices. Immediately in January, 31% of the tax increase was passed on to consumer prices. Pass-through increased to 58% in the following six months, which corresponds to a causal consumer price increase of about 6.5%. The presumed increase in demand for gastronomy services due to hosting the UEFA Euro 2024 tournament did not alter the path of price adjustments compared to previous months.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWho Bears the Cost? High-Frequency Evidence on Minimum Wage Effects and Amenity Pass-Through in Spot Labor Markets

Suguru Otani, Sho Miyaji, Hayato Kanayama

Healthcare effects and evidence robustness of reimbursable digital health applications in Germany: a systematic review.

Deckert, Stefanie, Schmitt, Jochen, Scheibe, Madlen et al.

Exchange Rate Pass-Through and Data Frequency: Firm-Level Evidence from Bangladesh

Md Deluair Hossen

Identification and Estimation of Causal Effects in High-Frequency Event Studies

Alessandro Casini, Adam McCloskey

No citations found for this paper.

Comments (0)