Summary

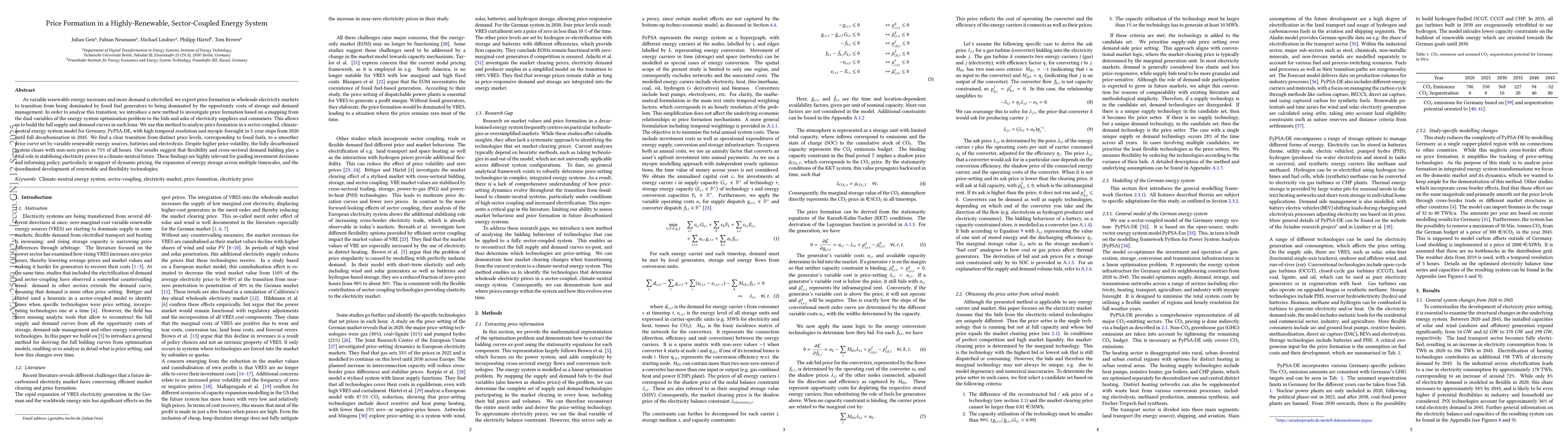

As variable renewable energy increases and more demand is electrified, we expect price formation in wholesale electricity markets to transition from being dominated by fossil fuel generators to being dominated by the opportunity costs of storage and demand management. In order to analyse this transition, we introduce a new method to investigate price formation based on a mapping from the dual variables of the energy system optimisation problem to the bids and asks of electricity suppliers and consumers. This allows us to build the full supply and demand curves in each hour. We use this method to analyse price formation in a sector-coupled, climate-neutral energy system model for Germany, PyPSA-DE, with high temporal resolution and myopic foresight in 5-year steps from 2020 until full decarbonisation in 2045. We find a clear transition from distinct price levels, corresponding to fossil fuels, to a smoother price curve set by variable renewable energy sources, batteries and electrolysis. Despite higher price volatility, the fully decarbonised system clears with non-zero prices in 75% of all hours. Our results suggest that flexibility and cross-sectoral demand bidding play a vital role in stabilising electricity prices in a climate-neutral future. These findings are highly relevant for guiding investment decisions and informing policy, particularly in support of dynamic pricing, the expansion of energy storage across multiple timescales, and the coordinated development of renewable and flexibility technologies.

AI Key Findings

Generated Oct 18, 2025

Methodology

The research employs a techno-economic model to analyze electricity market dynamics under varying CO2 emission constraints, incorporating detailed technology cost assumptions and dispatch rules for different energy carriers.

Key Results

- Electricity prices in 2045 show a wide range due to increased renewable penetration and storage flexibility

- Flexible technologies like PHS and batteries dominate price-setting in high-decarbonization scenarios

- Market clearing prices exhibit significant temporal variation, with peak prices exceeding 350 e/MWh in certain periods

Significance

This study provides critical insights into how decarbonization pathways will reshape electricity markets, informing policy makers and industry stakeholders about necessary infrastructure investments and market mechanisms.

Technical Contribution

Develops a comprehensive framework for analyzing electricity market evolution with decarbonization, integrating multi-carrier dispatch models and techno-economic parameters across different time horizons.

Novelty

Introduces a dynamic price-setting analysis approach that explicitly considers both supply-side flexibility and demand-side responsiveness across varying decarbonization levels, distinguishing it from static market equilibrium analyses.

Limitations

- Assumes perfect foresight which may not reflect real-world forecasting uncertainties

- Does not account for cross-border electricity trade complexities

Future Work

- Incorporate real-time pricing mechanisms and demand response capabilities

- Analyze the impact of hydrogen storage on long-term price dynamics

- Include uncertainty quantification in renewable generation forecasts

Paper Details

PDF Preview

Similar Papers

Found 4 papersCost and efficiency requirements for a successful electricity storage in a highly renewable European energy system

Ebbe Kyhl Gøtske, Gorm Bruun Andresen, Marta Victoria

REMIND-PyPSA-Eur: Integrating power system flexibility into sector-coupled energy transition pathways

Chen Chris Gong, Falko Ueckerdt, Robert Pietzcker et al.

Comments (0)