Summary

We consider a simplified version of the Wealth Game, which is an agent-based financial market model with many interesting features resembling the real stock market. Market makers are not present in the game so that the majority traders are forced to reduce the amount of stocks they trade, in order to have a balance in the supply and demand. The strategy space is also simplified so that the market is only left with strategies resembling the decisions of optimistic or pessimistic fundamentalists and trend-followers in the real stock market. A dynamical phase transition between a trendsetters' phase and a bouncing phase is discovered in the space of price sensitivity and market impact. Analysis based on a semi-empirical approach explains the phase transition and locates the phase boundary. A phase transition is also observed when the fraction of trend-following strategies increases, which can be explained macroscopically by matching the supply and demand of stocks.

AI Key Findings

Generated Sep 01, 2025

Methodology

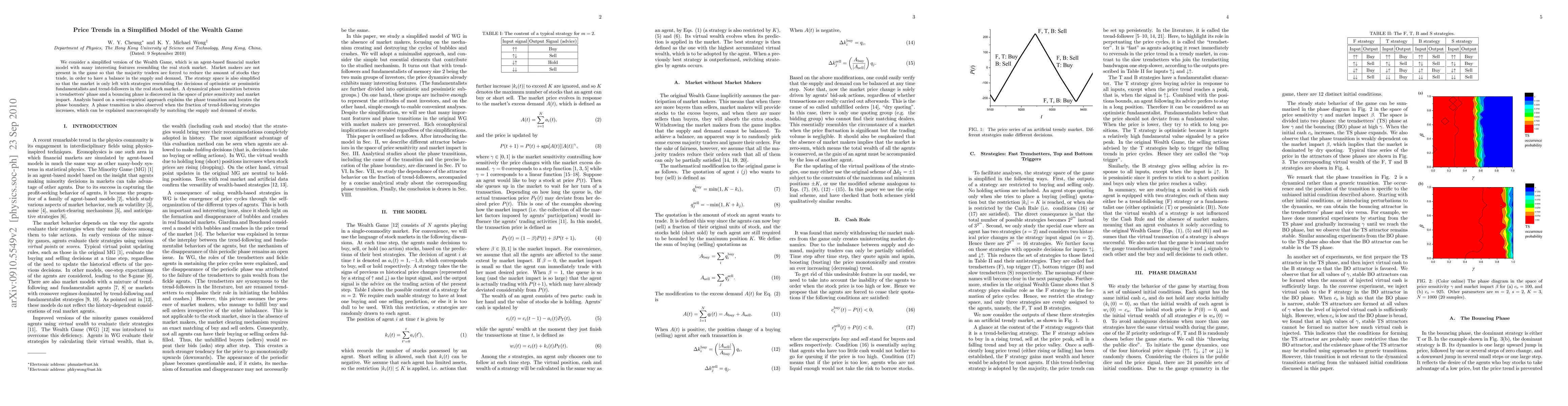

The research simplifies a Wealth Game model by reducing strategic dimensions to 2 and limiting strategies to F, T, and B, representing trend-followers/trendsetters, optimistic and pessimistic fundamentalists, and trend-followers, respectively. This simplification allows for the observation of a dynamical transition from the Trend Setter (TS) phase to the Bouncing (BO) phase as the price sensitivity (γ) increases.

Key Results

- A dynamical phase transition between a TS phase and a BO phase is discovered in the space of price sensitivity and market impact.

- The amplitude of price cycles is determined by the cash level of the most liquid agents.

- The TS phase disappears when the period of price cycles falls below an apparent universal value of 4K + 5.

- The composition of the population affects market behavior, with the TS phase present in markets dominated by trend-following strategies and transitioning to the BO phase as trend-following strategies become less popular.

- The study suggests a macroscopic condition for the disappearance of the TS phase by balancing the volume of supply and demand of stocks.

Significance

This research provides insights into the dynamics of financial markets by simplifying a complex model to identify key factors driving price trends, bubbles, and crashes, which can inform trading strategies and market regulation.

Technical Contribution

The study introduces a simplified Wealth Game model to analyze price trends, bubbles, and crashes, identifying a dynamical phase transition and deriving conditions for the disappearance of the Trend Setter phase.

Novelty

The paper's novelty lies in its simplified model that captures essential market dynamics, revealing a dynamical phase transition and providing a macroscopic condition for the disappearance of the Trend Setter phase, which is different from existing research focusing on more complex models with market makers.

Limitations

- The model lacks market makers, which may impact the balance of buying and selling quotations.

- The model heavily depends on initial conditions, making it challenging to generalize results.

- The absence of market makers leads to dry quotations, which might not fully represent real-world market dynamics.

Future Work

- Investigate the impact of incorporating market makers into the model.

- Explore the effects of varying initial conditions to enhance the model's generalizability.

- Study the implications of cash injection into the market to reduce dry quotations and enhance self-organization of markets.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)