Summary

To overcome the #P-hardness of computing/updating prices in logarithm market scoring rule-based (LMSR-based) combinatorial prediction markets, Chen et al. [5] recently used a simple Bayesian network to represent the prices of securities in combinatorial predictionmarkets for tournaments, and showed that two types of popular securities are structure preserving. In this paper, we significantly extend this idea by employing Bayesian networks in general combinatorial prediction markets. We reveal a very natural connection between LMSR-based combinatorial prediction markets and probabilistic belief aggregation,which leads to a complete characterization of all structure preserving securities for decomposable network structures. Notably, the main results by Chen et al. [5] are corollaries of our characterization. We then prove that in order for a very basic set of securities to be structure preserving, the graph of the Bayesian network must be decomposable. We also discuss some approximation techniques for securities that are not structure preserving.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

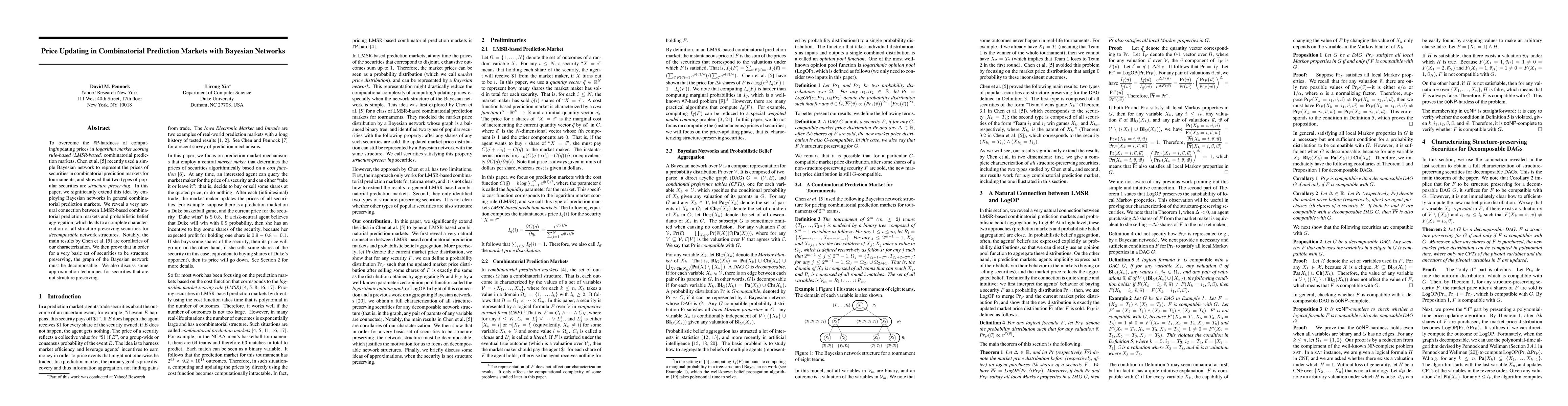

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrice Interpretability of Prediction Markets: A Convergence Analysis

Jianjun Gao, Zizhuo Wang, Dian Yu et al.

Price Formation in Field Prediction Markets: the Wisdom in the Crowd

Peter Bossaerts, Anne-Louise Ponsonby, Nitin Yadav et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)