Summary

Valuing Guaranteed Minimum Withdrawal Benefit (GMWB) has attracted significant attention from both the academic field and real world financial markets. As remarked by Yang and Dai, the Black and Scholes framework seems to be inappropriate for such a long maturity products. Also Chen Vetzal and Forsyth in showed that the price of these products is very sensitive to interest rate and volatility parameters. We propose here to use a stochastic volatility model (Heston model) and a Black Scholes model with stochastic interest rate (Hull White model). For this purpose we present four numerical methods for pricing GMWB variables annuities: a hybrid tree-finite difference method and a Hybrid Monte Carlo method, an ADI finite difference scheme, and a Standard Monte Carlo method. These methods are used to determine the no-arbitrage fee for the most popular versions of the GMWB contract, and to calculate the Greeks used in hedging. Both constant withdrawal, optimal surrender and optimal withdrawal strategies are considered. Numerical results are presented which demonstrate the sensitivity of the no-arbitrage fee to economic, contractual and longevity assumptions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

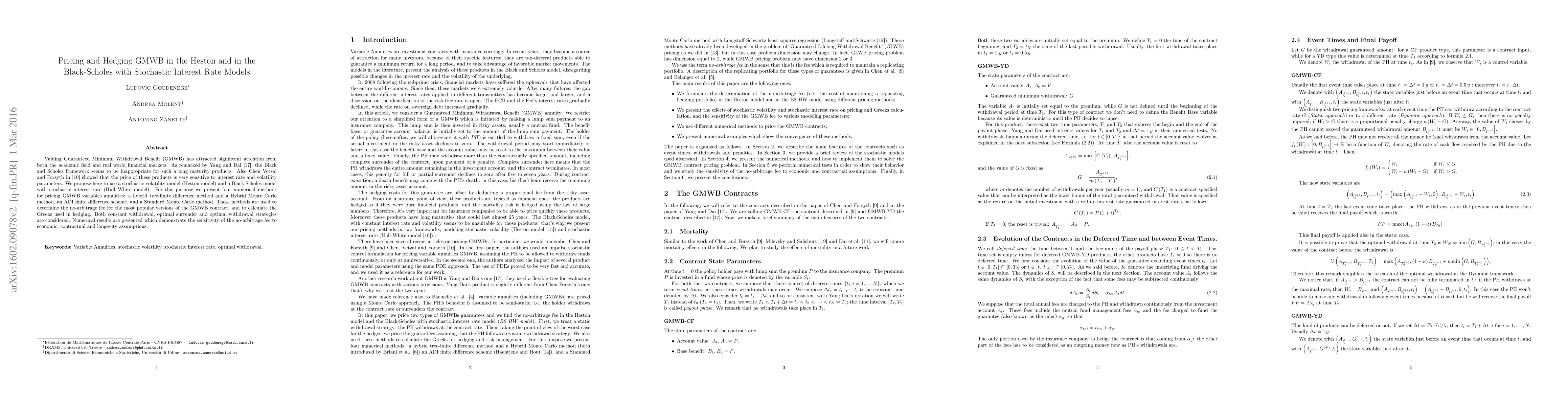

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)