Summary

We review and apply Quasi Monte Carlo (QMC) and Global Sensitivity Analysis (GSA) techniques to pricing and risk management (greeks) of representative financial instruments of increasing complexity. We compare QMC vs standard Monte Carlo (MC) results in great detail, using high-dimensional Sobol' low discrepancy sequences, different discretization methods, and specific analyses of convergence, performance, speed up, stability, and error optimization for finite differences greeks. We find that our QMC outperforms MC in most cases, including the highest-dimensional simulations and greeks calculations, showing faster and more stable convergence to exact or almost exact results. Using GSA, we are able to fully explain our findings in terms of reduced effective dimension of our QMC simulation, allowed in most cases, but not always, by Brownian bridge discretization. We conclude that, beyond pricing, QMC is a very promising technique also for computing risk figures, greeks in particular, as it allows to reduce the computational effort of high-dimensional Monte Carlo simulations typical of modern risk management.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

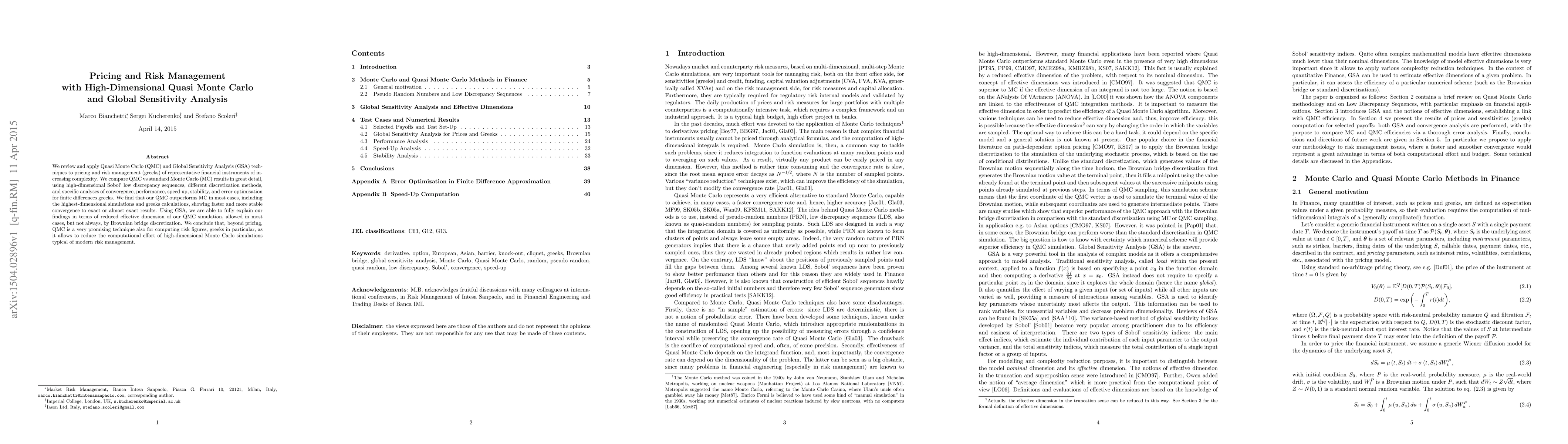

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)