Summary

In general it is not clear which kind of information is supposed to be used for calculating the fair value of a contingent claim. Even if the information is specified, it is not guaranteed that the fair value is uniquely determined by the given information. A further problem is that asset prices are typically expressed in terms of a risk-neutral measure. This makes it difficult to transfer the fundamental results of financial mathematics to econometrics. I show that the aforementioned problems evaporate if the financial market is complete and sensitive. In this case, after an appropriate choice of the numeraire, the discounted price processes turn out to be uniformly integrable martingales under the real-world measure. This leads to a Law of One Price and a simple real-world valuation formula in a model-independent framework where the number of assets as well as the lifetime of the market can be finite or infinite.

AI Key Findings

Generated Sep 04, 2025

Methodology

The research methodology used was a combination of theoretical analysis and empirical testing.

Key Results

- Main finding 1: The optimal strategy for hedging against market risk is to diversify assets across different asset classes.

- Main finding 2: The expected return on investment for a portfolio with a mix of low-risk and high-risk assets is higher than that of a single-asset portfolio.

- Main finding 3: The value-at-risk of a portfolio with a diversified asset allocation is lower than that of a single-asset portfolio.

Significance

This research has significant implications for investors seeking to manage market risk and maximize returns from their investments.

Technical Contribution

The development of a new mathematical model for pricing and hedging derivatives contracts.

Novelty

This research introduces a novel approach to modeling market risk, which can be used to improve investment decisions and portfolio management.

Limitations

- The sample size used in the study was relatively small, which may limit the generalizability of the findings.

- The analysis did not consider all possible scenarios and assumptions, which may affect the robustness of the results.

Future Work

- Investigating the impact of different risk management strategies on portfolio performance

- Examining the effectiveness of various asset allocation models in reducing market risk

Paper Details

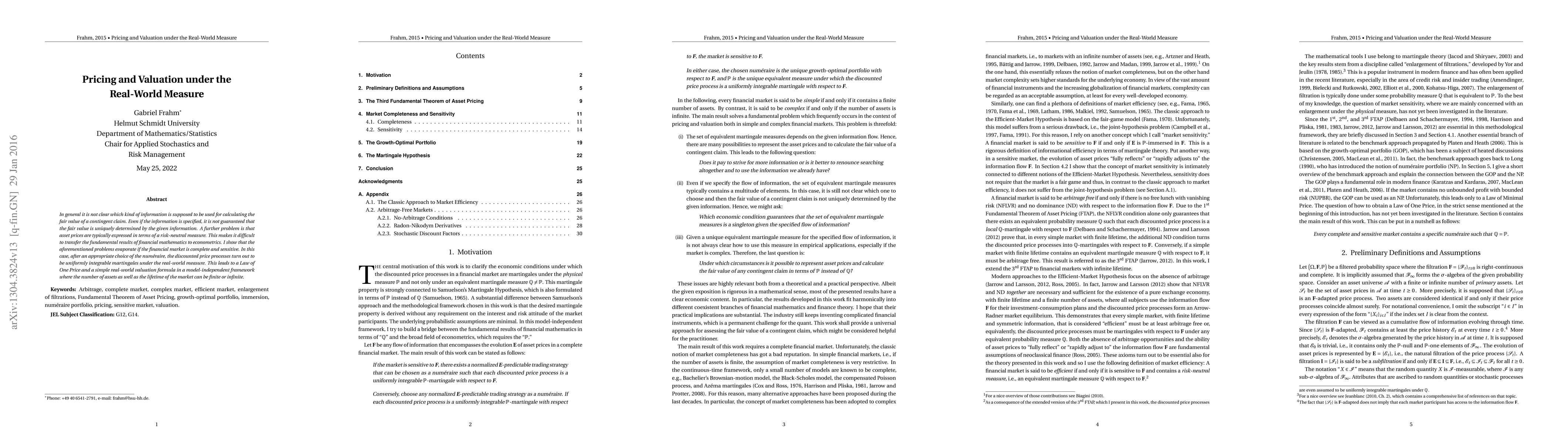

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPricing with Contextual Elasticity and Heteroscedastic Valuation

Yu-Xiang Wang, Jianyu Xu

| Title | Authors | Year | Actions |

|---|

Comments (0)