Authors

Summary

Options on baskets (linear combinations) of assets are notoriously challenging to price using even the simplest log-normal continuous-time stochastic models for the individual assets. The paper [5] gives a closed form approximation formula for pricing basket options with potentially negative portfolio weights under log-normal models by moment matching. This approximation formula is conceptually simple, methodologically sound, and turns out to be highly accurate. However it involves solving a system of nonlinear equations which usually produces multiple solutions and which is sensitive to the selection of initial values in the numerical procedures, making the method computationally challenging. In the current paper, we take the moment-matching methodology in [5] a step further by obtaining a closed form solution for this non-linear system of equations, by identifying a unary cubic equation based solely on the basket's skewness, which parametrizes all model parameters, and we use it to express the approximation formula as an explicit function of the mean, variance, and skewness of the basket. Numerical comparisons with the baskets considered in [5] show a very high level of agreement, and thus of accuracy relative to the true basket option price.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

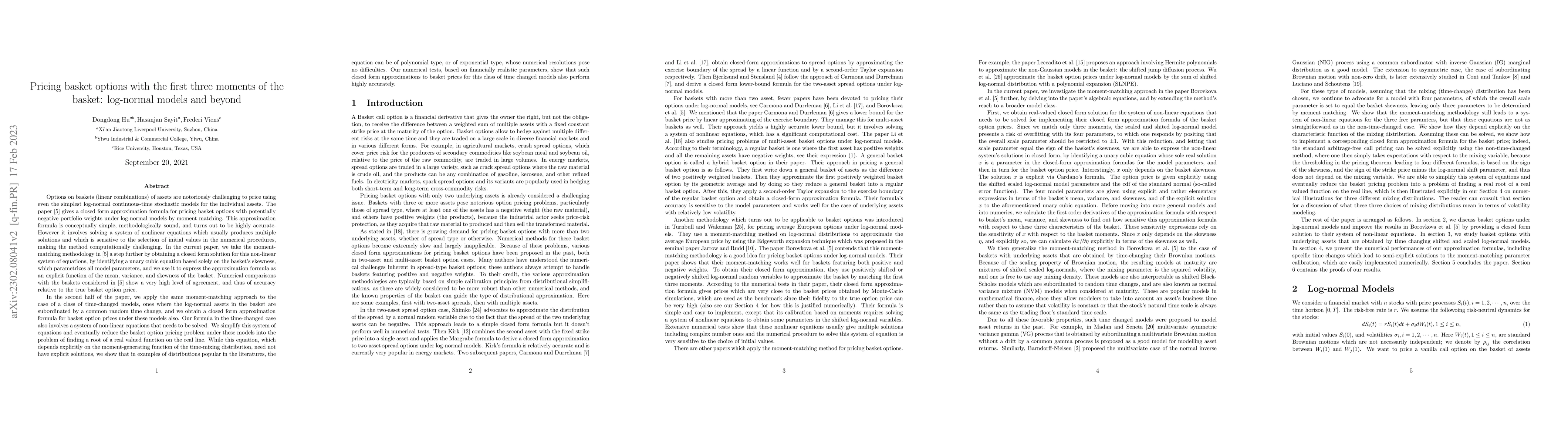

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)