Authors

Summary

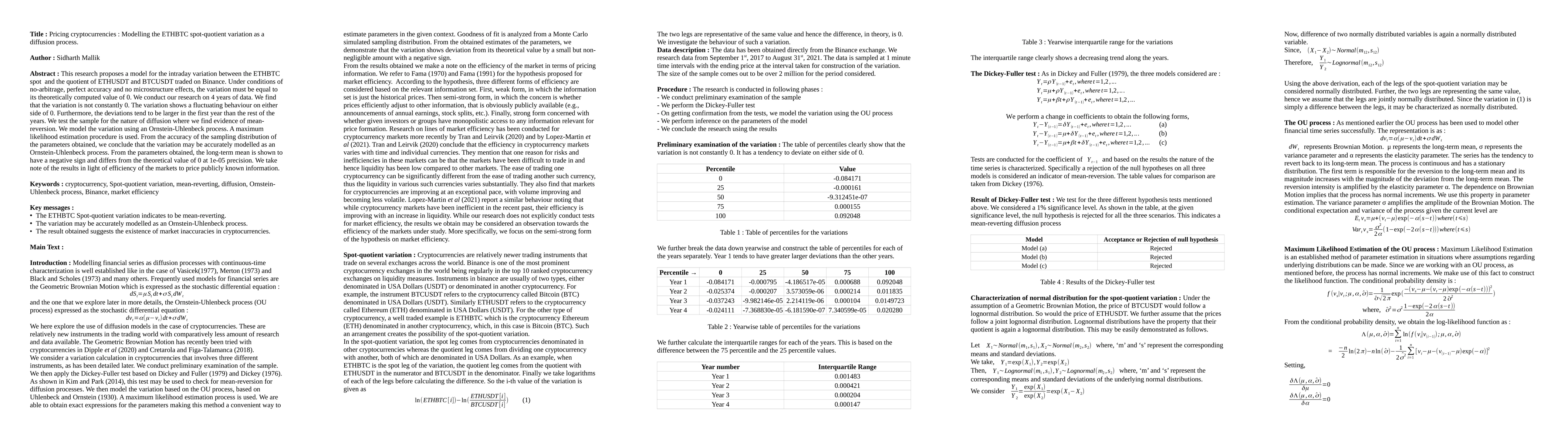

This research proposes a model for the intraday variation between the ETHBTC spot and the quotient of ETHUSDT and BTCUSDT traded on Binance. Under conditions of no-arbitrage, perfect accuracy and no microstructure effects, the variation must be equal to its theoretically computed value of 0. We conduct our research on 4 years of data. We find that the variation is not constantly 0. The variation shows a fluctuating behaviour on either side of 0. Furthermore, the deviations tend to be larger in the first year than the rest of the years. We test the sample for the nature of diffusion where we find evidence of mean-reversion. We model the variation using an Ornstein-Uhlenbeck process. A maximum likelihood estimation procedure is used. From the accuracy of the sampling distribution of the parameters obtained, we conclude that the variation may be accurately modelled as an Ornstein-Uhlenbeck process. From the parameters obtained, the long-term mean is shown to have a negative sign and differs from the theoretical value of 0 at 1e-05 precision. We take note of the results in light of efficiency of the markets to price publicly known information.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA new self-exciting jump-diffusion process for option pricing

Cornelis W. Oosterlee, Luis A. Souto Arias, Pasquale Cirillo

No citations found for this paper.

Comments (0)