Summary

This paper studies a valuation framework for financial contracts subject to reference and counterparty default risks with collateralization requirement. We propose a fixed point approach to analyze the mark-to-market contract value with counterparty risk provision, and show that it is a unique bounded and continuous fixed point via contraction mapping. This leads us to develop an accurate iterative numerical scheme for valuation. Specifically, we solve a sequence of linear inhomogeneous PDEs, whose solutions converge to the fixed point price function. We apply our methodology to compute the bid and ask prices for both defaultable equity and fixed-income derivatives, and illustrate the non-trivial effects of counterparty risk, collateralization ratio and liquidation convention on the bid-ask spreads.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

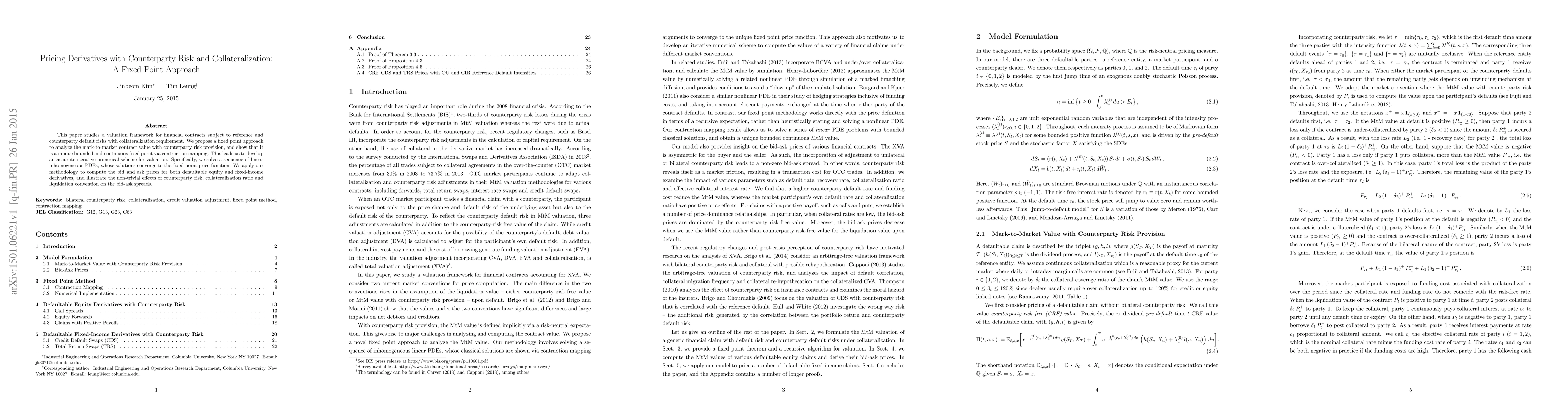

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)