Authors

Summary

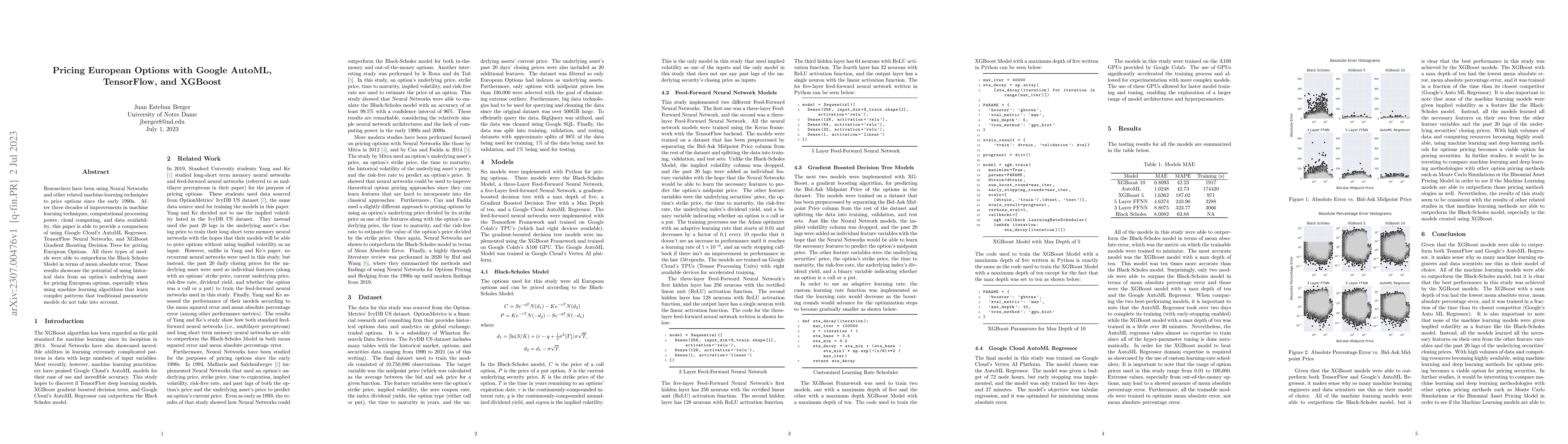

Researchers have been using Neural Networks and other related machine-learning techniques to price options since the early 1990s. After three decades of improvements in machine learning techniques, computational processing power, cloud computing, and data availability, this paper is able to provide a comparison of using Google Cloud's AutoML Regressor, TensorFlow Neural Networks, and XGBoost Gradient Boosting Decision Trees for pricing European Options. All three types of models were able to outperform the Black Scholes Model in terms of mean absolute error. These results showcase the potential of using historical data from an option's underlying asset for pricing European options, especially when using machine learning algorithms that learn complex patterns that traditional parametric models do not take into account.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)