Summary

In this manuscript we propose a method for pricing insurance products that cover not only traditional risks, but also unforeseen ones. By considering the Poisson process parameter to be a mixed random variable, we capture the heterogeneity of foreseeable and unforeseeable risks. To illustrate, we estimate the weights for the two risk streams for a real dataset from a Portuguese insurer. To calculate the premium, we set the frequency and severity as distributions that belong to the linear exponential family. Under a Bayesian setup , we show that when working with a finite mixture of conjugate priors, the premium can be estimated by a mixture of posterior means, with updated parameters, depending on claim histories. We emphasise the riskiness of the unforeseeable trend, by choosing heavy-tailed distributions. After estimating distribution parameters involved using the Expectation-Maximization algorithm, we found that Bayesian premiums derived are more reactive to claim trends than traditional ones.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

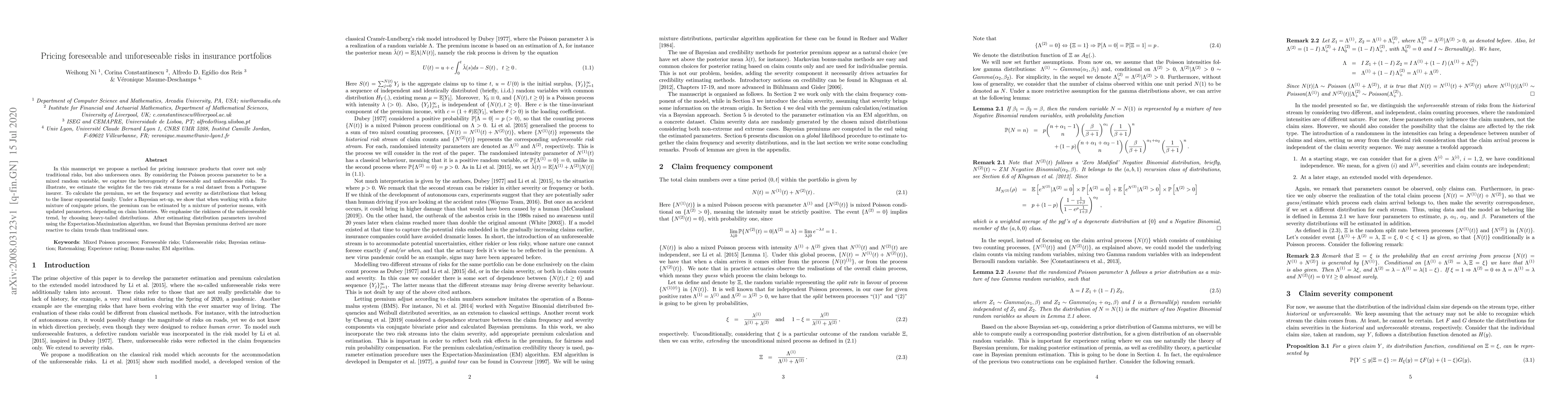

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModeling and Pricing Cyber Insurance -- Idiosyncratic, Systematic, and Systemic Risks

Stefan Weber, Gregor Svindland, Alexander Voß et al.

No citations found for this paper.

Comments (0)