Summary

The problem of obtaining market-clearing prices for markets with non-convexities has been widely studied in the literature. This is particularly the case in electricity markets, where worldwide deregulation leads to markets in which non-convexities arise from the decisions of market operators regarding which generators are committed to provide electricity power. Here, we extend seminal results in this area to address the problem of obtaining market-clearing prices for markets in which beyond non-convexities, it is relevant to account for convex quadratic market costs. In a general market, such costs arise from quadratic commodity costs or transactions costs. In an electricity market, such quadratic costs arise when ramping costs need to be considered due to the presence of renewable energy sources, which continue to increase their participation in electricity markets. To illustrate our results, we compute and analyze the clearing prices of a classical market problem with the addition of ramping costs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

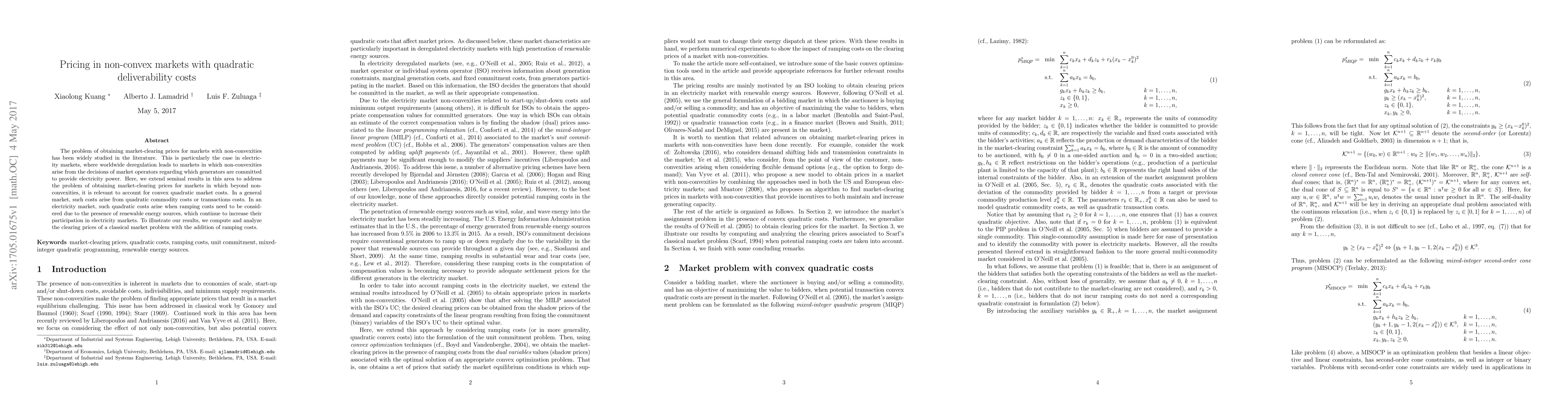

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPricing Optimal Outcomes in Coupled and Non-Convex Markets: Theory and Applications to Electricity Markets

Johannes Knörr, Martin Bichler, Mete Şeref Ahunbay

| Title | Authors | Year | Actions |

|---|

Comments (0)