Summary

In a stochastic volatility framework, we find a general pricing equation for the class of payoffs depending on the terminal value of a market asset and its final quadratic variation. This allows a pricing tool for European-style claims paying off at maturity a joint function of the underlying and its realised volatility/variance. We study the solution under different stochastic volatility models, give a formula for the computation of the Delta and Gamma of these claims, and introduce some new interesting payoffs that can be priced through this equation. Numerical results are given and compared to those from plain vanilla derivatives.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

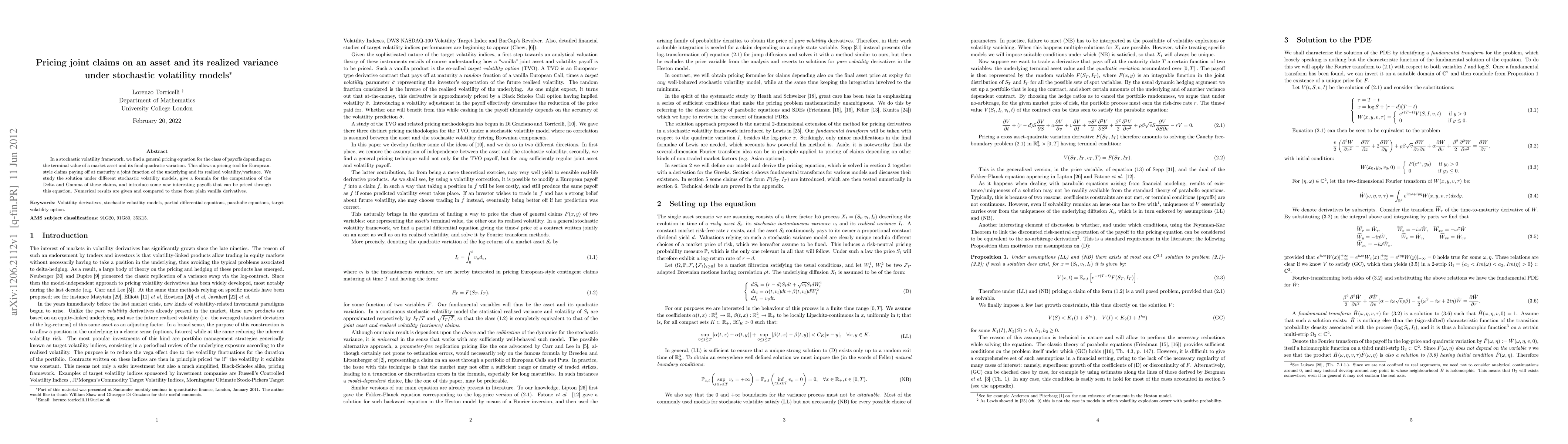

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersShort-maturity options on realized variance in local-stochastic volatility models

Xiaoyu Wang, Dan Pirjol, Lingjiong Zhu

| Title | Authors | Year | Actions |

|---|

Comments (0)