Summary

We present new numerical schemes for pricing perpetual Bermudan and American options as well as $\alpha$-quantile options. This includes a new direct calculation of the optimal exercise barrier for early-exercise options. Our approach is based on the Spitzer identities for general L\'evy processes and on the Wiener-Hopf method. Our direct calculation of the price of $\alpha$-quantile options combines for the first time the Dassios-Port-Wendel identity and the Spitzer identities for the extrema of processes. Our results show that the new pricing methods provide excellent error convergence with respect to computational time when implemented with a range of L\'evy processes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

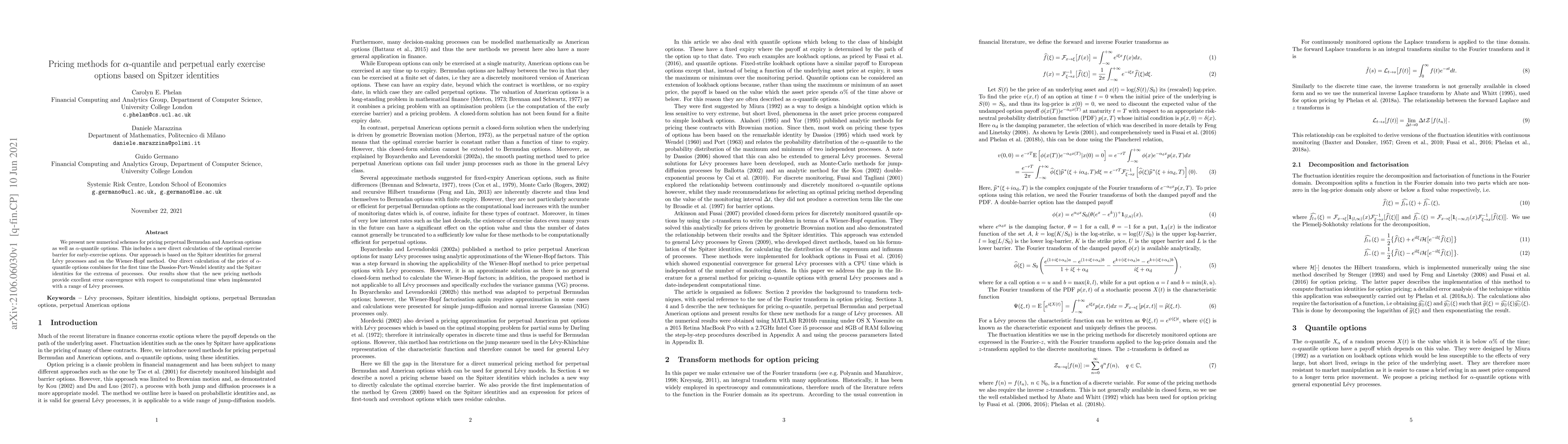

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)