Authors

Summary

A pricing principle is introduced for non-attainable $q$-exponential bounded contingent claims in an incomplete Brownian motion market setting. The buyer evaluates the contingent claim under the ``distorted Radon-Nikodym derivative'' and adjustment by Tsallis relative entropy over a family of equivalent martingale measures. The pricing principle is proved to be a time consistent and arbitrage-free pricing rule. More importantly, this pricing principle is found to be closely related to backward stochastic differential equations with generators $f(y)|z|^2$ type. The pricing functional is compatible with prices for attainable claims. Except translation invariance, the pricing principle processes lots of elegant properties such as monotonicity and concavity etc. The pricing functional is showed between minimal martingale measure pricing and conditional certainty equivalent pricing under $q$-exponential utility. The asymptotic behavior of the pricing principle for ambiguity aversion coefficient is also investigated.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

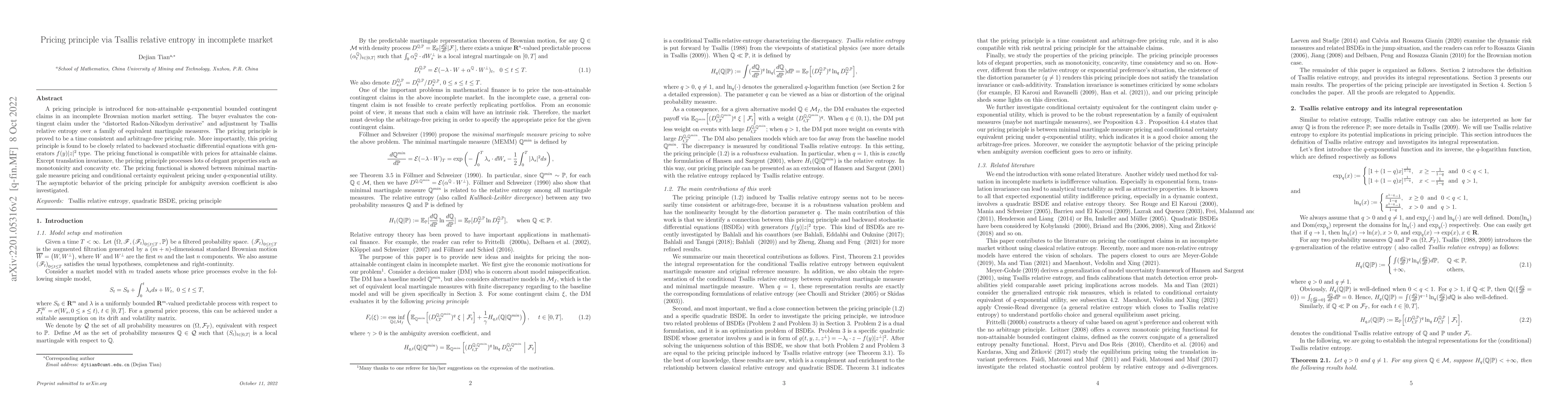

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMaximum principle for robust utility optimization via Tsallis relative entropy

Peng Luo, Dejian Tian, Xueying Huang

| Title | Authors | Year | Actions |

|---|

Comments (0)